Grow a Small Account Day Trading Faster Than Ever In 2025 | Money & Risk Management Trading Course

Summary

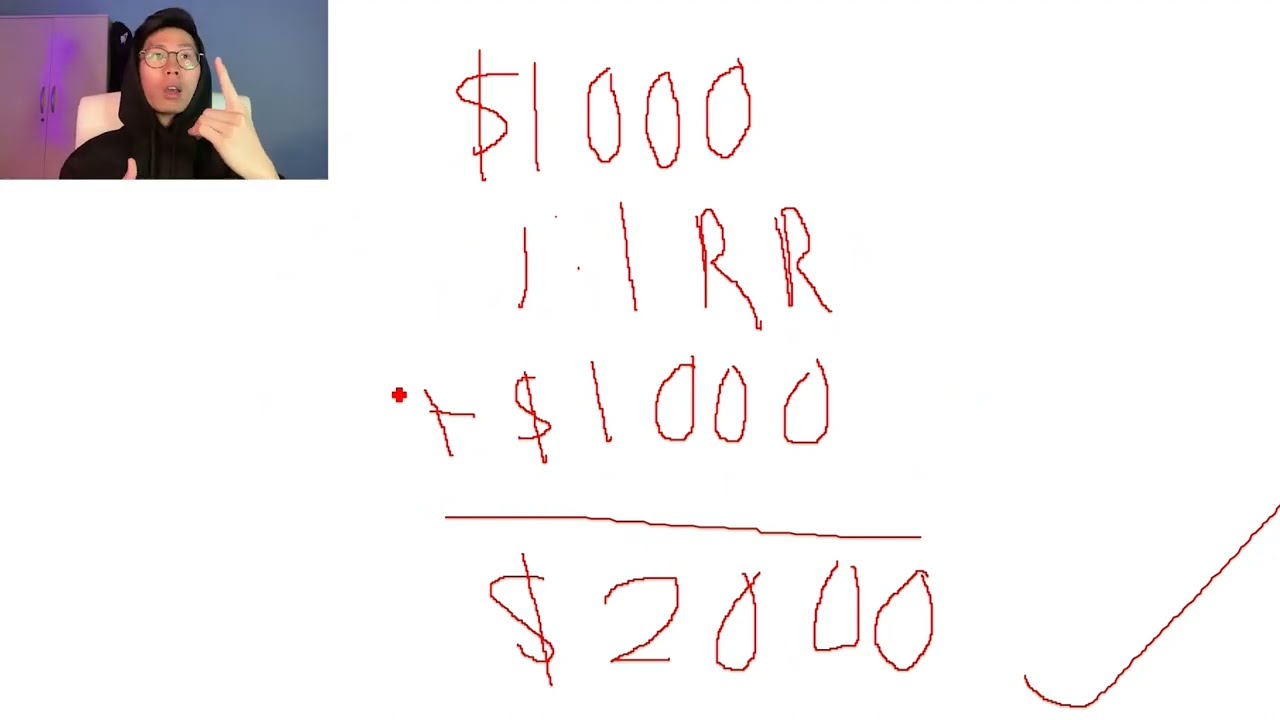

TLDRThis video emphasizes the importance of a disciplined, mechanical trading strategy for growing a small account. It advocates for a consistent, risk-managed approach, focusing on a 1% daily profit target and scaling up position sizes only after proven success. By using precise, rule-based strategies and a position sizing calculator, traders can avoid emotional decisions and minimize the risks of overtrading. The key to success is creating repeatable, systematic processes, managing risk effectively, and staying disciplined to grow steadily without taking unnecessary risks.

Takeaways

- 😀 Set a realistic goal: Aim for 1% daily growth, focusing on consistency rather than chasing big profits.

- 😀 Lot scaling method: Start with small positions and increase size only after your account grows by 20%.

- 😀 Use a 2:1 risk-to-reward ratio: This ensures you can still profit even if you're wrong more often than right.

- 😀 Stop trading after three consecutive losses: This helps prevent emotional, revenge-driven trading.

- 😀 Use breakeven technique: Move your stop loss to breakeven once a trade has moved in your favor, protecting your capital.

- 😀 When testing new strategies, use half the usual position size until the strategy proves itself over 10 trades.

- 😀 Focus on the first 3 hours of the trading session: Volatility is highest during this period, increasing the chances of profitable trades.

- 😀 Stick to the first 70% of the daily price range: Most significant market moves happen early in the session.

- 😀 Apply a time stop: Exit a trade if it hasn’t hit its target by the end of the trading day, ensuring your capital isn’t tied up unnecessarily.

- 😀 Align your trades with the higher timeframe trend: This increases your chances of being on the right side of the market and capitalizing on institutional moves.

- 😀 Use a position sizing calculator: This ensures you don’t over-leverage and helps with precise risk management by automatically calculating trade sizes.

Q & A

What is the goal of aiming for a 1% profit per day?

-Aiming for a 1% profit per day is a sustainable strategy for small account growth. It allows traders to make 2-3 trades a day, generating controlled, consistent profits. Compounding these daily profits can lead to a 10% monthly return without taking excessive risks.

Why should traders avoid random position sizing?

-Random position sizing increases the risk of overleveraging and emotional decision-making. Using a position sizing calculator helps traders determine the right risk for each trade, ensuring consistent and disciplined risk management.

What is the benefit of starting with small position sizes when growing a small account?

-Starting with small position sizes allows traders to manage risk more effectively and prove their strategy's effectiveness without putting significant capital at risk. This approach helps to minimize the impact of potential losses while gaining experience and confidence.

How does the 2:1 profit target rule work in practice?

-The 2:1 profit target rule dictates that traders should always aim to make at least twice the amount they are willing to risk. For example, if you risk $50 on a trade, your profit target should be $100. This risk-to-reward ratio ensures profitability even with a relatively low win rate.

What should a trader do after three consecutive losses?

-After three consecutive losses, a trader should stop trading for the day. This rule helps to prevent revenge trading and emotional decisions, protecting the trader’s capital and allowing them to return with a clearer mindset the next day.

Why is moving the stop loss to breakeven a good practice?

-Moving the stop loss to breakeven once a trade hits a 1:1 risk-to-reward ratio ensures that no matter what happens, the trader won't incur a loss on the trade. It locks in profits and reduces the emotional stress of watching a trade turn from profitable to a loss.

What does the 'half-size rule' recommend when testing a new strategy?

-The half-size rule suggests trading with half of your normal position size when testing new strategies or markets. This approach minimizes risk while allowing you to evaluate the strategy’s performance. Only after achieving consistent success should you increase your position size.

Why focus on the first 3 hours of market activity?

-The first 3 hours of the market session typically offer the highest volatility and trading opportunities. Traders should focus on these hours to capitalize on larger price movements, while avoiding the slower, more unpredictable periods later in the day.

What is the importance of trading within the first 70% of the daily range?

-Trading within the first 70% of the daily range helps avoid the choppy market conditions that often arise later in the day. It ensures that trades are taken during more predictable, clear market movements, which increases the likelihood of success.

Why should traders close positions before major news events?

-Closing positions before major economic news releases is a risk management strategy to avoid unexpected volatility and price swings. News events can cause rapid, unpredictable market moves that might lead to losses, so it's safer to exit trades beforehand.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

I Found the Formula to Grow a Small Forex Account FAST in 2025

Simple $100 SWING TRADING Strategy | Beginner Guide 2025

How to Grow SMALL Forex Account with little money (No Bullsh*t Guide)

Cara Grow FOREX MODAL 50 RIBU DENGAN CEPAT di Tahun 2025

How To Start Options Trading with a $1,000 Account

Smartest Route To $10,000/Month Trading in 2024 (With ZERO Experience)

5.0 / 5 (0 votes)