1ª Aula - Planeamento Financeiro

Summary

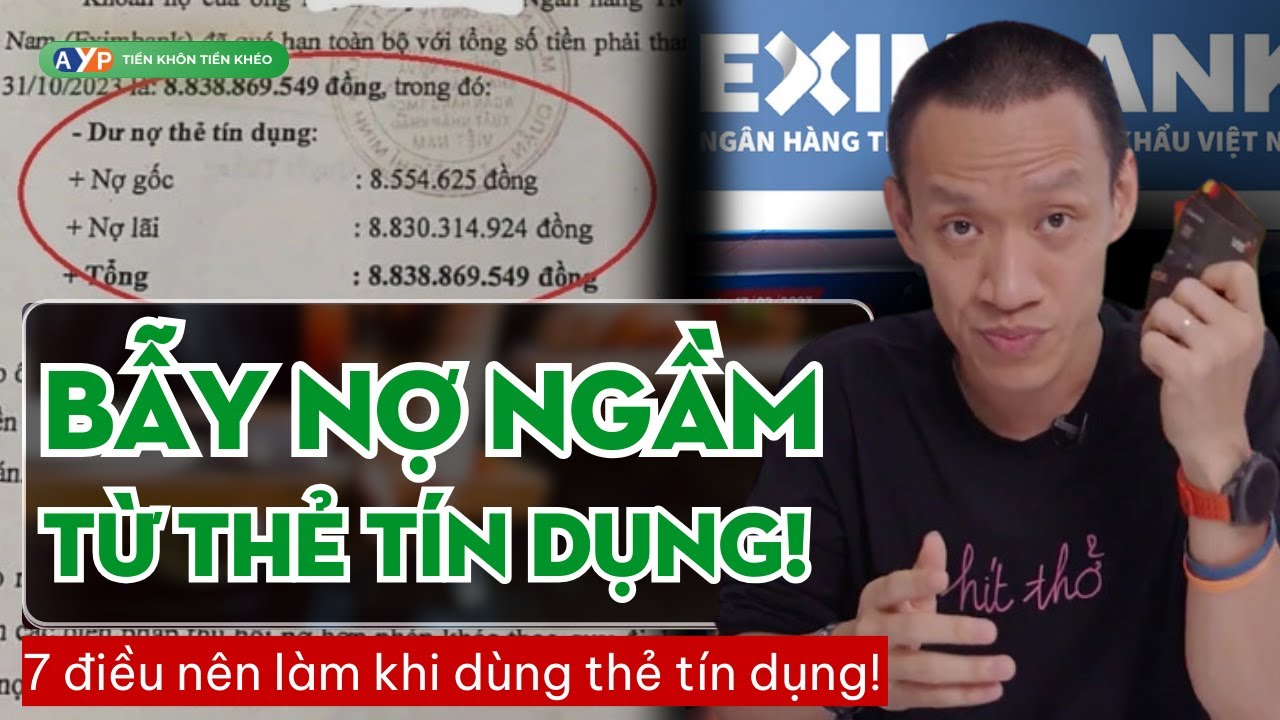

TLDRThis video emphasizes the importance of financial planning for home buying or improving existing housing credit terms. It outlines key steps like evaluating personal accounts, setting goals, creating a budget, and maintaining good banking practices. The speaker advises on proving financial capability with documented income, maintaining good account standing, and the significance of timely credit card payments. They also stress the importance of savings habits and creating a financial score to secure better housing loans. The video shares a real-life story to illustrate the impact of proper financial management on credit approval.

Takeaways

- 🏦 The importance of financial planning is highlighted for purchasing a home, building, or improving existing housing credit conditions.

- 📑 It's crucial to have well-documented financial reality to prove to banks your ability to pay for housing loans.

- 💼 Having good bank account conduct is important, which means regular income and expenditure patterns that can demonstrate your financial reliability.

- 💰 All income, including extra earnings, should be deposited into the same bank account to show consistent financial activity.

- 🏠 If you're applying for a housing loan, systematically paying rent through your bank account can demonstrate your ability to make regular payments.

- 🔍 Banks will look at your financial effort, which is what you can afford monthly, and your bank statements will reflect this.

- 💳 Proper use of credit cards, including timely full payments, is viewed positively by banks and shows good financial planning.

- 💲 Regular savings, even small amounts, can make a significant difference and contribute to a good banking score.

- 📊 Having a clear budget for expenses and income is essential and should be reflected in your bank statements for better financial planning.

- 👨👩👧👦 The story of a family struggling to get housing credit due to unverified income and payments highlights the necessity of proper financial documentation.

- 🔄 The process of financial planning involves understanding one's total financial reality, consolidating bank accounts, and proving regular income and expenses to secure loans.

Q & A

What is the primary focus of this video?

-The video focuses on financial planning, specifically for purchasing, building, or improving a home loan. It aims to explain the importance of financial preparation and offers tips for negotiating better mortgage terms with banks.

Why is having a well-managed bank account important when applying for a home loan?

-A well-managed bank account is crucial because it reflects the applicant's financial discipline and ability to handle monthly expenses. This includes showing regular income deposits and timely bill payments, which help prove creditworthiness to the bank.

What documents are typically required when applying for a home loan?

-Applicants must provide documents that verify their financial situation, such as bank statements, proof of income, and details of any other sources of revenue. This documentation helps prove the applicant's ability to repay the loan.

How can paying rent through a bank account help when applying for a home loan?

-Paying rent through a bank account creates a record of regular payments, which shows the bank that the applicant has the financial discipline to meet monthly housing costs, similar to a future mortgage payment.

Why is it beneficial to clear credit card balances in full every month?

-Paying off credit card balances in full each month demonstrates financial planning and responsibility, which appeals to banks. It also avoids interest charges and improves the applicant's credit score.

What role does saving play in financial planning for a home loan?

-Saving, even in small amounts, helps build financial security and demonstrates responsible financial behavior. Consistent savings can accumulate over time, providing a cushion for unexpected expenses or a down payment for a home.

What is 'scoring,' and how does it affect the home loan application process?

-'Scoring' refers to the bank's evaluation of the applicant's financial behavior, based on their bank account management, credit history, and spending habits. A good score improves the likelihood of getting approved for a loan with favorable terms.

How does consolidating financial activities into one account benefit the home loan process?

-Consolidating financial activities into one account simplifies tracking income and expenses, making it easier for the bank to assess the applicant’s financial stability. It provides a clearer picture of their financial habits and responsibilities.

What is a financial emergency fund, and why is it important?

-A financial emergency fund is a savings buffer, typically covering six months of expenses, which protects against unforeseen financial difficulties. It's crucial for managing unexpected costs, such as fluctuations in mortgage interest rates.

What is the significance of preparing a detailed budget in the home loan process?

-Preparing a detailed budget helps applicants understand their monthly income, expenses, and savings potential. It allows them to identify areas where they can cut costs or save more, improving their financial readiness for taking on a mortgage.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

Best Credit Card For Students | Best Credit Cards | Credit Cards For Beginners

10 Frugal Living Tips To Become Debt Free (Financial Freedom)

COMPRA Tu Primera CASA - 8 Pasos Esenciales

Can you move your mortgage when you move house?

Sau vụ nợ từ 8,5 triệu thành 8,8 tỷ: NÊN và KHÔNG NÊN làm gì khi xài THẺ TÍN DỤNG!| Nguyễn Hữu Trí

Análise de crédito: O que é e como funciona? - Serasa Ensina

5.0 / 5 (0 votes)