Zenginler Nasıl Borçla Servet Kazanıyor? Bu 5 Yolu Öğrenin!

Summary

TLDRThis script explores how debt can be both a powerful tool and a potential pitfall for wealth creation. It delves into historical examples like Rockefeller's use of debt to build an empire, and modern instances such as Elon Musk leveraging debt to maintain cash flow and avoid taxes. The narrative also touches on strategies like using debt to acquire real estate or assets, and the importance of understanding financial laws to maximize benefits. The key takeaway is that debt, when strategically managed, can be a catalyst for wealth accumulation and financial freedom.

Takeaways

- 📚 The speaker reads over 50 books a year to learn from the rich and apply systematic solutions to avoid mistakes.

- 💸 Debt can be a tool for the rich to make more money, but if not managed properly, it can lead to financial ruin.

- 🏭 The story of Rockefeller illustrates how debt was used to build an empire, starting from a $1,000 loan to creating Standard Oil.

- 🚗 Rich individuals often live a luxurious lifestyle without paying from their salaries, like Elon Musk, who uses stocks as collateral for loans instead of selling them.

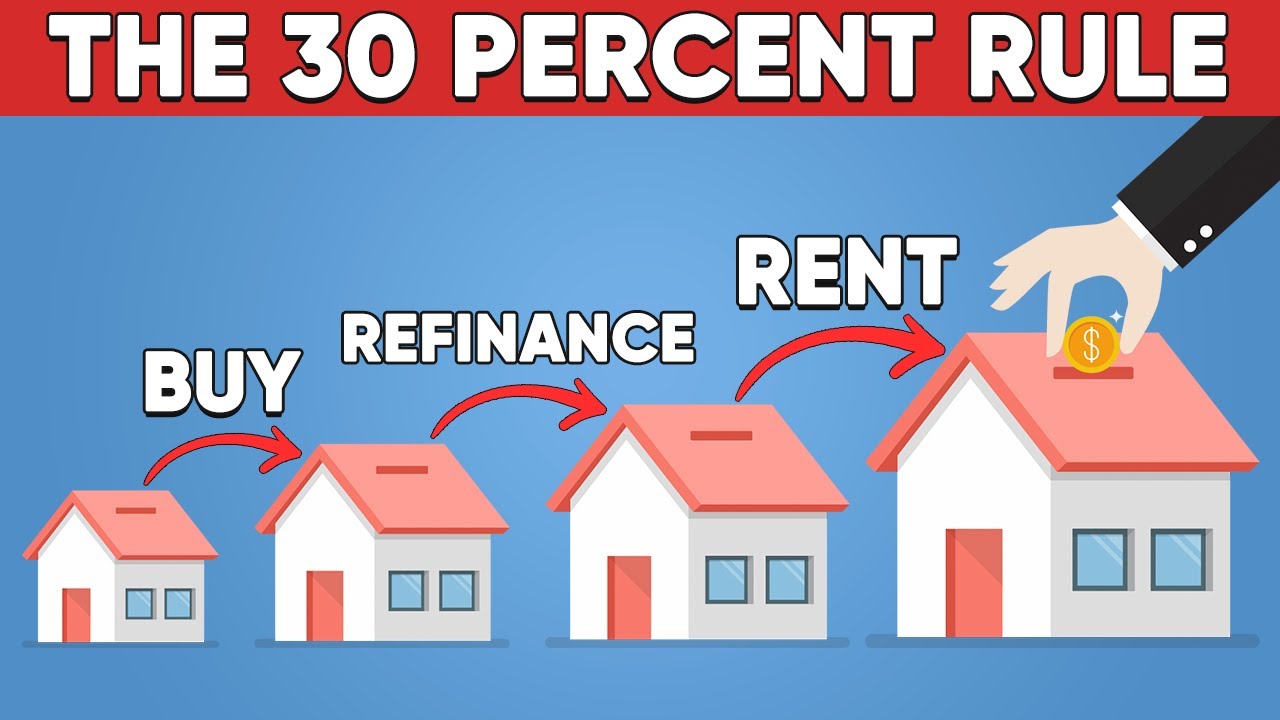

- 🏡 Wealthy people use debt to acquire multiple properties as investments, which they do not necessarily occupy themselves.

- 💰 The rich prefer to use debt to maintain liquidity and seize profitable opportunities rather than tying up their cash in assets.

- 🌐 For the wealthy, leveraging debt can be advantageous in high-interest environments, as they can earn higher returns on their cash than the interest on their debt.

- 💼 Tax laws play a significant role in the strategies of the rich, as they often find legal ways to minimize their tax liabilities.

- 🔄 The rich are adept at converting non-liquid assets into liquid assets through strategic borrowing to take advantage of investment opportunities.

- 🌱 The script emphasizes the importance of strategic debt management, where the wealthy use debt to grow and protect their wealth.

Q & A

What is the potential impact of debt on an individual's financial situation?

-Debt can make an individual super wealthy or bankrupt overnight, depending on how it is managed. It can either empower dreams and ventures or become a burden.

How did John D. Rockefeller leverage debt to build his wealth?

-Rockefeller used his first loan of $1000 to build a vast fortune by innovating in the oil industry, reducing costs, and acquiring competitors, eventually creating the Standard Oil which refined 90% of America's oil.

What is the significance of paying off debt on time according to the script?

-Paying off debt on time is crucial as it helps maintain a good credit score and financial reputation, which can lead to more opportunities for growth and investment.

How do wealthy individuals use debt to maintain their lifestyle without paying salaries?

-Wealthy individuals often live off debt by using their assets, like stocks, as collateral for loans, allowing them to enjoy a luxurious lifestyle without needing a salary and also avoiding capital gains tax.

Why do rich people prefer debt over cash for purchasing real estate?

-Rich people prefer debt for real estate because it allows them to leverage their cash for potentially higher returns elsewhere and take advantage of tax benefits and inflation, which can reduce the real value of their debt over time.

What is the advantage of using debt to acquire non-liquid assets according to the script?

-Using debt to acquire non-liquid assets allows individuals to maintain liquidity for seizing investment opportunities while also potentially benefiting from the appreciation of the assets over time.

How does the script suggest wealthy individuals use debt to their strategic advantage?

-Wealthy individuals use debt strategically to capture significant opportunities and preserve their assets, often by leveraging low-interest rates and the power of inflation to their benefit.

What is the importance of understanding tax laws when using debt as a financial tool?

-Understanding tax laws is essential when using debt to ensure that one can take advantage of tax benefits and avoid unnecessary tax liabilities that could arise from certain financial transactions.

Why did Elon Musk take a loan instead of selling his shares to buy real estate?

-Elon Musk took a loan to buy real estate to avoid selling his shares, which would have resulted in capital gains tax, and instead used the shares as collateral for the loan, which allows him to maintain control of his assets and benefit from potential appreciation.

How does the script explain the strategy of using debt to convert illiquid assets into liquid assets?

-The script explains that using debt to convert illiquid assets into liquid assets allows individuals to unlock the value of their assets without selling them, providing the necessary liquidity to pursue other investment opportunities.

What is the significance of the historical context provided about debt in the script?

-The historical context provided in the script is significant as it illustrates how debt has been used throughout history to create wealth and empires, setting the stage for understanding modern financial strategies involving debt.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

How Rich People Use Debt to Build Wealth (...and YOU can, too!)

Top Experts' Insights on Mutual Funds - How Mutual Funds Can Transform Your Wealth

5 Ways Rich People Make Money With Debt

A Woman's SEXUAL ENERGY IS THE KEY to A Man's Abundance (Ancient Tantra)

HOW DEBT CAN GENERATE INCOME -ROBERT KIYOSAKI

This is Why YOU are BROKE! The Most Evil Product Created?

5.0 / 5 (0 votes)