Dediklerimi Yaparsanız Zengin Olabilirsiniz ! Paranızı Eritmeyin ! @FerdaYildirim

Summary

TLDRThe video discusses the detrimental effects of credit card usage, emphasizing the psychological impact of spending and the traps set by banks to increase consumer debt. It offers practical advice on financial freedom, highlighting the importance of saving, avoiding unnecessary expenses, and making wise investments. The conversation touches on avoiding toxic influences, the benefits of small investments, and the significance of living within one's means. The video aims to inspire viewers to achieve financial independence through disciplined spending and strategic financial planning.

Takeaways

- 💡 People tend to spend less when using cash because it causes psychological pain, unlike using credit cards which provide a sense of pleasure.

- 📉 Reducing credit card usage for 1-2 months can decrease consumption by 10-20%.

- 💸 Credit cards are designed to increase spending by delaying the pain of payment and enhancing the pleasure of purchasing.

- ❌ Avoid having toxic people around you, whether they are friends or family, as they can negatively influence your financial decisions.

- 🏡 Selling real estate should be a last resort; renting out a small property is often more beneficial in the long run.

- 🛑 Question every purchase: Do you really need this item? Avoid spending to impress others.

- 🛍️ Online shopping can lead to unnecessary spending due to targeted advertisements and ease of purchase with credit cards.

- 🌟 Financial freedom involves saving and investing small amounts consistently, rather than accumulating large debts.

- 🏦 Consider individual retirement accounts and investment funds to build long-term wealth, but be aware of the types of funds you invest in.

- 📉 Economic downturns and periods of market instability often present the best opportunities for investing and purchasing assets at lower prices.

Q & A

Why should people stop using credit cards according to the speaker?

-The speaker argues that using credit cards increases consumption due to the psychological effects of spending without immediate pain, as opposed to spending cash, which causes a tangible loss feeling. Credit cards create a sense of false wealth and convenience, leading to more spending.

What psychological effects are associated with using cash versus credit cards?

-Spending cash triggers a sense of pain and loss, which helps in controlling expenditures. In contrast, using credit cards generates a feeling of pleasure and ease, which can lead to overspending.

What are the benefits of cutting credit card usage for a month or two?

-Cutting credit card usage for one or two months can reduce consumption by 10-20%. This reduction occurs because people become more mindful of their spending when they have to use cash instead of credit.

Why does the speaker suggest avoiding toxic people?

-Toxic people can influence and negatively impact your financial decisions and overall well-being. They may encourage unnecessary spending and foster a materialistic mindset, hindering financial freedom and personal growth.

What does the speaker say about the necessity of keeping properties?

-The speaker advises against selling properties unless absolutely necessary. Renting out smaller properties can be more advantageous as it provides a steady income stream, and properties generally appreciate over time.

How does the speaker view the impact of small savings?

-Small savings are crucial as they can accumulate over time and provide significant financial opportunities in the future. Even modest amounts set aside regularly can lead to substantial wealth accumulation.

What is the speaker's stance on consumerism and capitalism?

-The speaker criticizes consumerism and capitalism for promoting unnecessary spending and materialism. They argue that capitalism offers comfort at the expense of freedom, making people more like slaves to their desires and financial obligations.

What strategy does the speaker recommend for achieving financial freedom?

-The speaker recommends living frugally and saving money to create a financial buffer. This buffer allows for more freedom and flexibility in making career and lifestyle choices without being bound by financial constraints.

Why does the speaker emphasize the importance of financial education?

-Financial education is crucial for making informed decisions about saving, investing, and spending. Understanding financial principles helps individuals avoid debt traps and make choices that lead to long-term financial stability.

How does the speaker view the relationship between wealth and happiness?

-The speaker argues that wealth does not necessarily equate to happiness. Many wealthy individuals are not happy despite their financial status. True happiness comes from meaningful pursuits and relationships, not from accumulating material possessions.

Outlines

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraMindmap

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraKeywords

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraHighlights

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraTranscripts

Esta sección está disponible solo para usuarios con suscripción. Por favor, mejora tu plan para acceder a esta parte.

Mejorar ahoraVer Más Videos Relacionados

A ARMADILHA do Cartão de Crédito?! (Eles não querem que você saiba disso..)

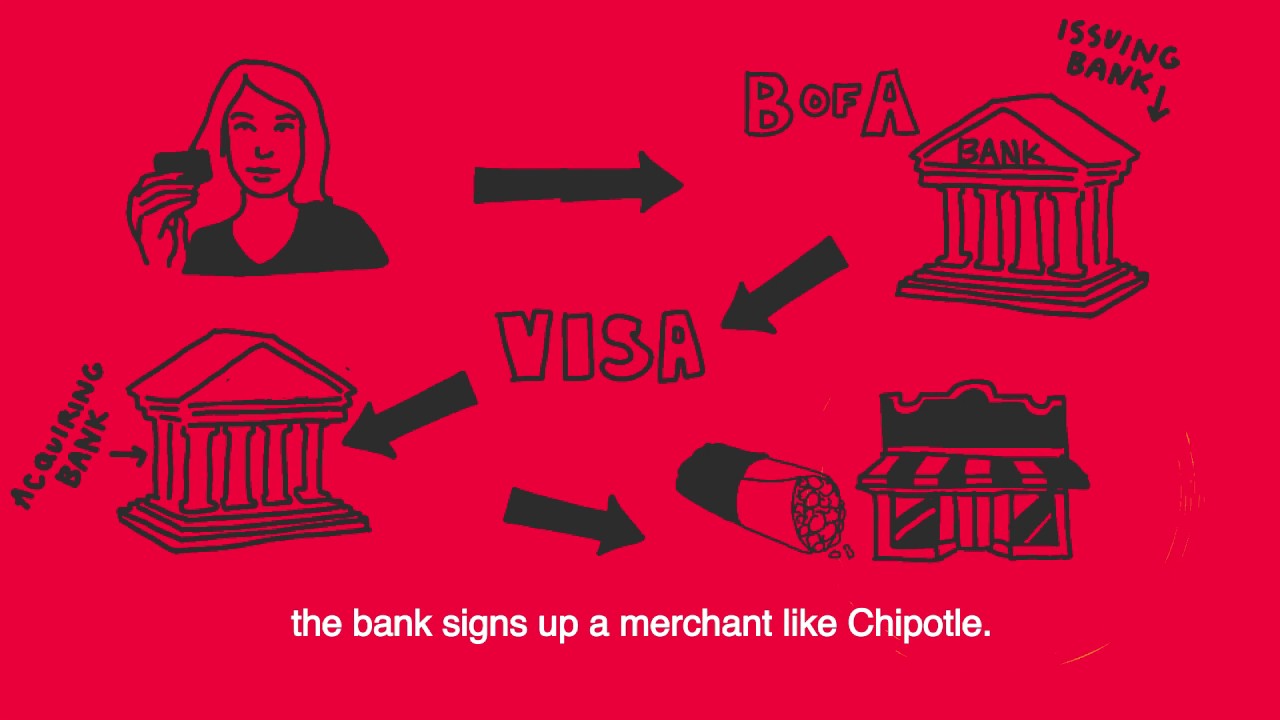

How we got hooked on credit cards - Nidhi Upadhyaya

How the IMF Debt Trapped Kenya Causing Nationwide Protests

This is Why YOU are BROKE! The Most Evil Product Created?

Lesson 2 Credit Cards, Interest and Debt

A Brief History of Credit Cards (or What Happens When You Swipe)

5.0 / 5 (0 votes)