หลักกฎหมายประกันสังคม

Summary

TLDRThe Social Security Act of Thailand, enacted in 1990, ensures the welfare and economic stability of workers by providing benefits like healthcare, unemployment compensation, and accident coverage. It defines insured persons under different sections: Section 33 covers employees, Section 39 allows former employees to continue coverage, and Section 40 provides options for self-employed individuals. The Act also includes a compensation fund for work-related accidents, and contributions are shared between employees, employers, and the government, with varying amounts based on the category of insurance.

Takeaways

- 😀 The Social Security Act (1990) in Thailand protects the welfare of employees through a social security system that covers health care, unemployment benefits, retirement, and more.

- 😀 The law provides for the establishment of a compensation fund to protect workers in case of work-related accidents.

- 😀 A 'social security contributor' is defined as someone who contributes to the system and is entitled to benefits as per the Act.

- 😀 Employees contributing under Section 33 are those working in establishments with at least one employee and are aged between 15 to 60 years.

- 😀 Employers, employees, and the government must contribute monthly to the social security fund, with a base contribution range between 1,650 to 15,000 Baht per month.

- 😀 Contributions under Section 33 are shared: 5% from the employee’s wages, with the employer matching the contribution.

- 😀 Section 39 is for those who previously contributed under Section 33 but are no longer eligible, but wish to continue contributing voluntarily.

- 😀 Contributors under Section 39 must contribute a fixed amount of 432 Baht per month, calculated from a base salary of 4,800 Baht, at a rate of 9%.

- 😀 Section 40 applies to self-employed individuals who are not covered by Sections 33 or 39, or government employees, but wish to have social security coverage.

- 😀 Section 40 offers three contribution options: 70 Baht, 100 Baht, or 300 Baht per month, with each option covering different benefits.

Q & A

What is the Social Security Act (พระราชบัญญัติประกันสังคม พ.ศ. 2533) in Thailand?

-The Social Security Act is a law in Thailand designed to protect workers' welfare. It establishes a social security system covering healthcare, unemployment compensation, retirement benefits, and other forms of social insurance to ensure economic stability and improved living conditions for workers.

Who is considered an insured person under the Social Security Act?

-An insured person is someone who pays contributions to the social security fund, which entitles them to receive various benefits as outlined by the law. The definition includes individuals who contribute under Section 33, 39, and 40.

What are the main benefits provided under the Social Security system?

-The main benefits include healthcare, unemployment compensation, old-age benefits, and compensation for work-related accidents, all designed to ensure the worker's well-being and economic security.

What is the role of employers in the Social Security system under Section 33?

-Under Section 33, employers are required to contribute to the social security fund on behalf of their employees. The employer and the government together contribute a percentage of the employee's wages to the fund.

What are the criteria for an individual to be eligible for coverage under Section 33?

-An individual is eligible if they are an employee working in an establishment with at least one worker, are between the ages of 15 and 60, and earn a monthly wage between 1,650 and 15,000 baht.

What does Section 39 of the Social Security Act entail?

-Section 39 applies to individuals who were previously covered under Section 33 but whose coverage has ended. These individuals can voluntarily continue their coverage under Section 39 by paying a fixed contribution.

What is the contribution rate for insured persons under Section 39?

-Under Section 39, the insured person must contribute a fixed amount of 432 baht per month, based on a contribution rate of 9% of 4,800 baht per month.

Who qualifies for coverage under Section 40 of the Social Security Act?

-Section 40 is for individuals who are self-employed, not covered under Sections 33 or 39, and are not government employees or state enterprise workers. They can voluntarily join the social security system.

What are the three contribution options for insured persons under Section 40?

-Under Section 40, individuals can choose from three contribution options: 70 baht, 100 baht, or 300 baht per month, with each option offering different levels of coverage.

How is the contribution for workers under Section 33 calculated?

-For workers under Section 33, the contribution is calculated as a percentage of their wages. The employer deducts 5% of the employee's wages, and the employer matches this amount, contributing the same value to the social security fund.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

Social Security Act of 2018

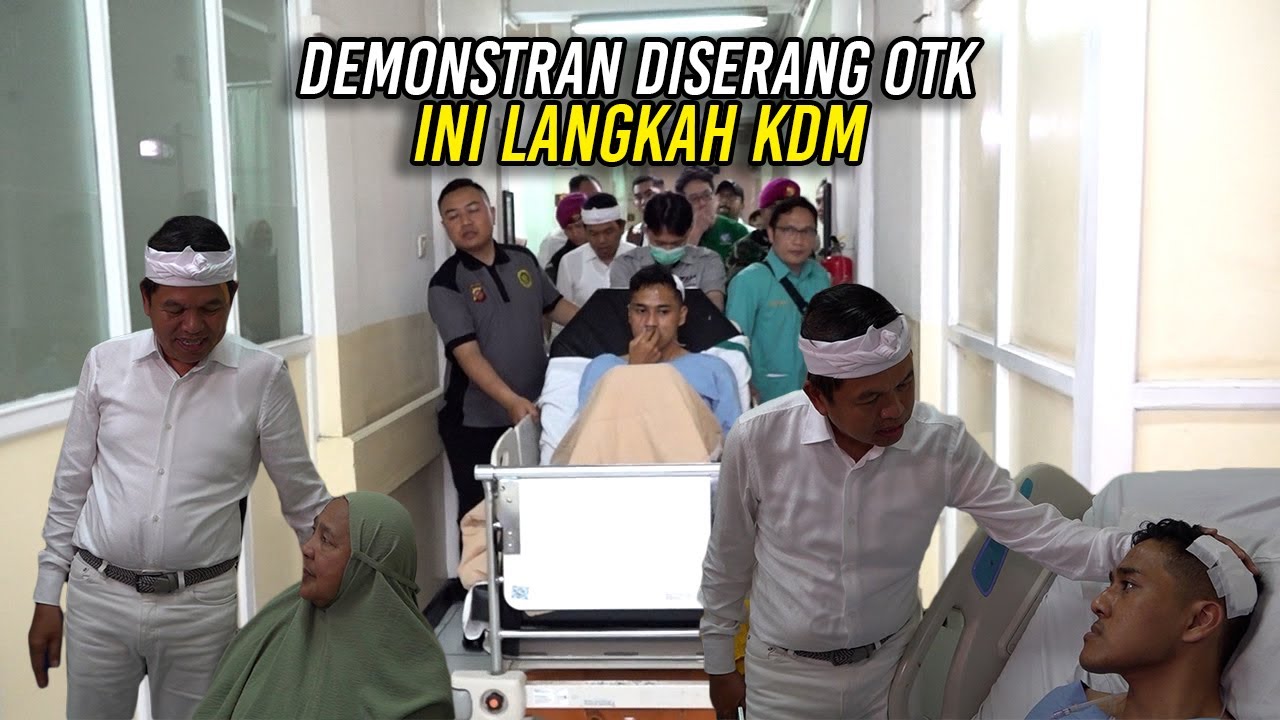

DEMONSTRAN D1SERANG OTK | INI LANGKAH KDM SELESAIKAN PERAWATAN DI RUM4H SAK1T

Shocking Social Security Update: Millions to Receive BIGGER Checks in 2025! 💰🚨

Korean industrial accidents compensation insurance - disability benefits and survivors’ benefit

Modul JKK & JKM 1 #1

Post-WWII DEMOCRACIES in Europe [AP Euro Review—Unit 9 Topic 6]

5.0 / 5 (0 votes)