Le monde est-il en train de se "dédollariser" ?

Summary

TLDRThe video script from teredefrance.fr discusses the shifting global financial landscape, focusing on the potential end of the petrodollar era initiated 50 years ago. It explores the implications of Saudi Arabia's move to diversify from the US dollar in energy transactions, the potential for economic booms in regions like the Indian Ocean, and the challenges France faces with its bond market and national sovereignty. The conversation with Charles Gave of the Institute of Liberty touches on the broader consequences of these financial shifts, including the possibility of an attack on France's bond market and the need for France to assert its independence, possibly by exiting the Euro.

Takeaways

- 📉 The agreement between Saudi Arabia and the USA to use the dollar for all energy transactions is ending.

- 💸 Saudi Arabia is now open to using other currencies such as the Chinese yuan and the euro for oil transactions.

- 🌐 The dominance of the dollar in global energy transactions allowed the USA significant control over other economies.

- 🔄 This shift could lead to major changes in the global financial system, reducing the dependency on the dollar.

- 🏦 The BRICS countries' foreign ministers recently held a meeting discussing this new monetary approach.

- ⚖️ The move away from the dollar might affect countries with large dollar reserves, causing potential financial instability.

- 📈 Countries like India, which have strong growth rates, might benefit by being able to pay for energy in their own currency.

- 💥 The new decentralized payment system could replace the centralized SWIFT system.

- 🇫🇷 The situation might create economic challenges for France, which relies heavily on foreign investment in its bonds.

- 🚨 There could be potential attacks on France's bond market, pushing interest rates higher and destabilizing its economy.

Q & A

What significant anniversary is being mentioned in the transcript?

-The transcript mentions the 50th anniversary of the agreement between Saudi Arabia and the USA, where it was decided that the dollar would be used in all energy and petroleum transactions.

What recent change has Saudi Arabia made regarding its currency for energy transactions?

-Saudi Arabia has decided to start using currencies other than the dollar, such as the yuan and the euro, for energy transactions.

How did the petrodollar system benefit the United States?

-The petrodollar system allowed the United States to maintain economic control because all countries needed dollars to buy energy, giving the US significant financial leverage.

What could be the impact of countries buying energy in their own currencies?

-Countries like India could experience economic growth without being constrained by the need to hold dollars, potentially leading to significant economic booms in various regions.

What is the expected consequence of the decline of the petrodollar system?

-There could be a significant shift in global financial power, with the US losing its financial leverage and countries no longer needing to hold large reserves of dollars.

How might the end of the petrodollar affect global reserves of dollars?

-There are between 3,000 and 4,000 billion dollars held in reserves for energy transactions that might become redundant, potentially causing inflation and devaluation issues similar to the historical decline of sterling reserves.

What is the 'Swift' system and how is it expected to change?

-The Swift system is a centralized payment system for international transactions. The change will lead to a more decentralized system where countries will settle transactions directly with each other in their own currencies or other agreed forms of payment.

How might the decline of the petrodollar impact European economies, specifically France?

-France, which relies heavily on foreign investment to finance its deficit, might face financial challenges if foreign investors stop buying French bonds. This could lead to higher interest rates and economic instability.

What is the significance of the 'law Sapin' in the context of the transcript?

-The 'law Sapin' allows France to take emergency measures to stabilize its bond market, such as temporarily closing the market or limiting transactions, to prevent economic collapse during a financial attack.

What are the broader geopolitical implications of the shift away from the dollar in energy transactions?

-The shift could lead to a realignment of global economic power, reducing US dominance and allowing emerging economies to grow faster. It also indicates a move towards a multipolar world with less dependence on any single currency or country.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

Introduction to Power Electronics - Overview

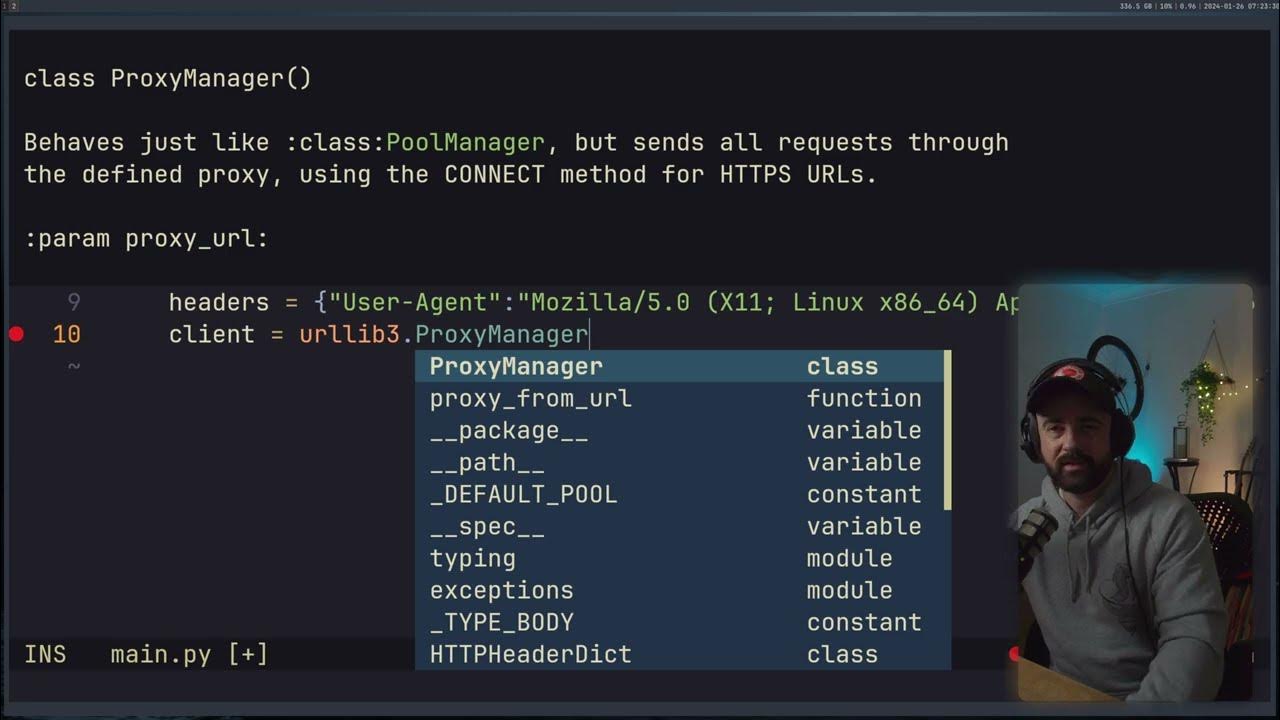

Try this SIMPLE trick when scraping product data

ALLAH, AGAMA & MANUSIA: Proses dan Tujuan Penciptaan Manusia | PAI ITN Malang

Віртуальна екскурсія Університетом Грінченка: корпус на Левка Лук'яненка 13Б

Importing Development Data | Lecture 92 | Node.JS 🔥

Went from Being Single to finding my LONDON BOY *here we go again?!* |VRIDDHI PATWA

How Chinese characters evolved | The Origin of Chinese characters | EXPLORE MODE

5.0 / 5 (0 votes)