Topic 205 – Presentation of Financial Statements | US GAAP Explained

Summary

TLDRThis video dives into the fundamentals of US financial statements, breaking down the five core statements required under US GAAP: the balance sheet, income statement, comprehensive income statement, cash flow statement, and the statement of changes in equity. It covers essential topics like materiality, applicability, reporting periods, and the importance of comparative statements. Key differences between public and private company requirements are explored, along with best practices for effective disclosure. Ultimately, the goal is to provide a clear framework to help users understand financial statements, their structure, and the reasoning behind them.

Takeaways

- 😀 Full financial statements under US GAAP include five key documents: the balance sheet, income statement (or net income), comprehensive income, statement of cash flows, and statement of changes in equity.

- 😀 Materiality in financial statements refers to whether information is significant enough to influence the decisions of stakeholders like investors or lenders.

- 😀 Comparative financial statements (showing multiple years side by side) provide valuable context, allowing users to spot trends and assess a company's trajectory.

- 😀 The SEC requires public companies to present two years for the balance sheet and three years for the income statement, cash flows, and equity changes, with exceptions for emerging growth companies.

- 😀 Private companies are encouraged to provide comparative statements, even though it's not a regulatory requirement, as it improves decision-making for investors, lenders, and management.

- 😀 Footnotes in financial statements should be consistent across comparative periods, ensuring that disclosures remain relevant and updated.

- 😀 The SEC does not mandate a specific chronological order for the columns in financial tables, but consistency is required within those tables across the entire filing.

- 😀 US GAAP is the standard for financial reporting in the US, and companies are prohibited from including non-GAAP measures in their primary financial statements, although they can be presented elsewhere with reconciliations.

- 😀 Companies must disclose their significant accounting policies and methods used, especially where those choices could materially impact financial interpretations.

- 😀 Estimates and assumptions are inherent in financial statements (e.g., asset depreciation or allowance for doubtful accounts), and companies must explicitly acknowledge these in their disclosures.

- 😀 Effective disclosures should prioritize clarity and organization, using plain language, logical grouping, and cross-referencing to enhance user understanding of the financial information.

Q & A

What are the five core financial statements under US GAAP?

-The five core financial statements under US GAAP are: the Balance Sheet, the Income Statement (Earnings or Net Income), the Statement of Comprehensive Income, the Statement of Cash Flows, and the Statement of Changes in Equity.

Why is it important to have comparative financial statements over multiple periods?

-Comparative financial statements over multiple periods help provide context and reveal trends, such as revenue growth or cost changes, allowing users to assess a company's trajectory and financial health.

What does the concept of materiality mean in financial reporting?

-Materiality refers to whether information is significant enough to potentially influence decisions made by investors, lenders, or other users of the financial statements. If an item is insignificant, it might not need to be reported in detail.

What is the role of the SEC in the reporting requirements for public companies?

-The SEC ensures that public companies adhere to specific rules, often adding extra requirements beyond GAAP to protect investors. These rules dictate the structure, disclosure, and presentation of financial statements for public companies.

How do the reporting periods for public companies differ for balance sheets and income statements?

-For public companies, the SEC generally requires two years of balance sheet data. However, for the income statement, statement of cash flows, and statement of changes in equity, the SEC typically requires three years of data to better understand trends and performance.

What is the significance of the basis of presentation in financial statements?

-The basis of presentation ensures that financial statements are prepared according to US GAAP (or IFRS for foreign issuers). Companies often disclose their adherence to GAAP in the notes to reinforce transparency and maintain consistency.

What is the purpose of disclosing significant accounting policies?

-Disclosing significant accounting policies helps users understand the principles and methods a company uses to prepare its financial statements, especially if those choices significantly affect the financial outcomes, such as inventory methods or complex revenue recognition.

Why do companies need to disclose estimates in their financial statements?

-Estimates are often used in areas like asset depreciation or allowance for doubtful accounts. Companies are required to disclose these estimates to highlight the inherent uncertainty in financial reporting and to provide more accurate context for users making decisions.

What is the importance of consistency in presenting financial data?

-Consistency is crucial in financial reporting to avoid confusion. For example, the SEC emphasizes maintaining a consistent chronological order of data across all tables and footnotes, ensuring that users can easily track trends and make comparisons.

How can private companies benefit from presenting comparative financial statements?

-Although not required, private companies benefit from presenting comparative financial statements as it offers a richer picture of their financial health. This helps management, investors, and banks make more informed decisions.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

Financial Statements - Interconnectivity

The Financial Statements & their Relationship / Connection | Explained with Examples

mgt201 short lectures || vu mgt201 short lectures || Mgt201 vu guess paper || vu mgt201 mcqs

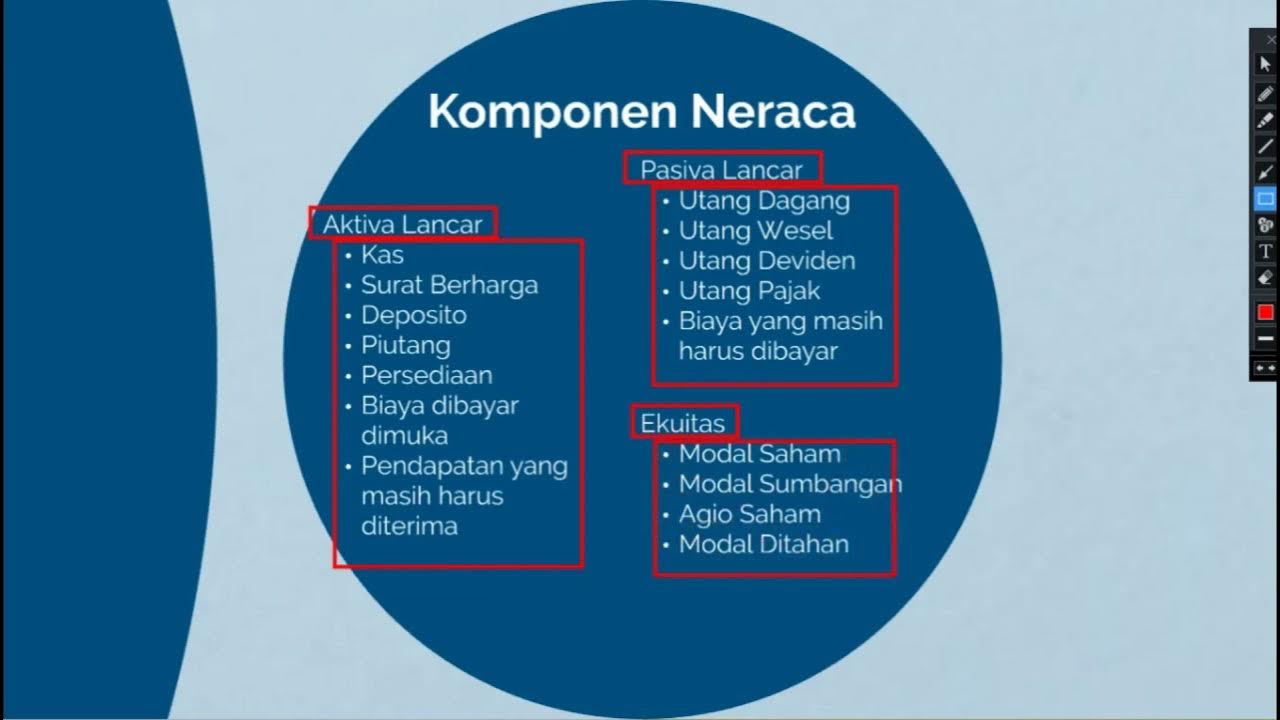

KD 3 10 MENGANALISIS LAPORAN KEUANGAN SEDERHANA || PRODUK KREATIF DAN KEWIRAUSAHAAN

Financial Statement Based on PAS #1

Video Pembelajaran Jenis Laporan keuangan

5.0 / 5 (0 votes)