Credit | DEBT | Finance & Economics

Summary

TLDRIn this video, the concept of credit is explained in a straightforward manner. Credit is the amount you can borrow, distinct from debt, which is the money you've already borrowed and need to repay. The video discusses the factors that determine your credit, such as credit history and assets, and the importance of using credit cards wisely. Credit cards can be helpful for maintaining a good credit score and even offer built-in insurance on certain purchases. The video highlights the difference between debt and credit and emphasizes the need for careful management to avoid overspending.

Takeaways

- 😀 Credit is the amount of money you can borrow, while debt is the amount you have already borrowed and must repay.

- 😀 A credit card is an example of credit, where you have a borrowing limit but must pay back what you use, often with interest.

- 😀 Your credit limit is determined by your credit history and ability to repay borrowed amounts.

- 😀 A good credit history, where you pay off debts on time, positively impacts your credit limit.

- 😀 You can set a limit on your credit card spending to avoid overspending and maintain control over your finances.

- 😀 Credit cards may offer benefits like built-in insurance on purchases, such as flight cancellations.

- 😀 Interest is typically charged on borrowed amounts, so it’s important to pay off credit balances to avoid paying more in interest.

- 😀 Credit limits are set by financial institutions (like banks) and may differ from person to person based on their financial profile.

- 😀 Personal limits on credit can also apply between individuals, where someone may set a limit on how much they are willing to lend you.

- 😀 The key difference between credit and debt is that credit is what you are allowed to borrow, while debt is the amount you already owe.

- 😀 Always be cautious when using credit, especially credit cards, to avoid falling into debt that you cannot easily repay.

Q & A

What is the difference between debt and credit?

-Debt is the amount of money you've borrowed and need to repay, often with interest, while credit refers to the amount of money you are allowed to borrow, which is determined by factors like your credit history and assets.

How does credit work in relation to a credit card?

-When you have a credit card, the credit limit is how much you can borrow or spend. However, you must pay back what you've borrowed, often with interest. If you reach your credit limit, you cannot borrow any more until you pay down your balance.

Can you exceed your credit limit on a credit card?

-No, if your credit limit is set at a certain amount, such as £5,000, you cannot spend more than that. You can only borrow up to that specified limit.

What factors determine how much credit you can borrow?

-Your credit limit is determined by factors like your credit history, how well you've paid off past debts, and potentially your assets or savings, which can act as collateral.

What role does credit history play in determining your credit limit?

-Your credit history shows how reliably you've repaid borrowed money in the past. A strong credit history where you paid back on time can help you qualify for higher credit limits.

Why is it beneficial to use a credit card even if you rarely use it?

-Using a credit card occasionally and paying it off promptly can help maintain a good credit score, which is beneficial for future borrowing and financial health.

How can credit cards help build a credit score?

-By using a credit card responsibly—making small purchases and paying them off in full each month—you can build a positive credit history, which can improve your credit score.

What is the advantage of setting a spending limit on a credit card?

-Setting a spending limit on your credit card helps prevent overspending and ensures you don't exceed what you can realistically repay, keeping your financial situation in check.

What are some benefits of using a credit card aside from borrowing money?

-Some credit cards offer built-in insurance for purchases, like flight cancellations, and other perks, making them more attractive for consumers who use them wisely.

How can individuals have credit between each other, and how does it differ from financial institutions?

-Individuals can lend money to each other with a set credit limit based on trust, such as lending £20 or £50. This is different from financial institutions like banks, where the amount of credit available is often determined by formal agreements and credit histories.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

Hidrostática (Conceito de Pressão) - Aula 01

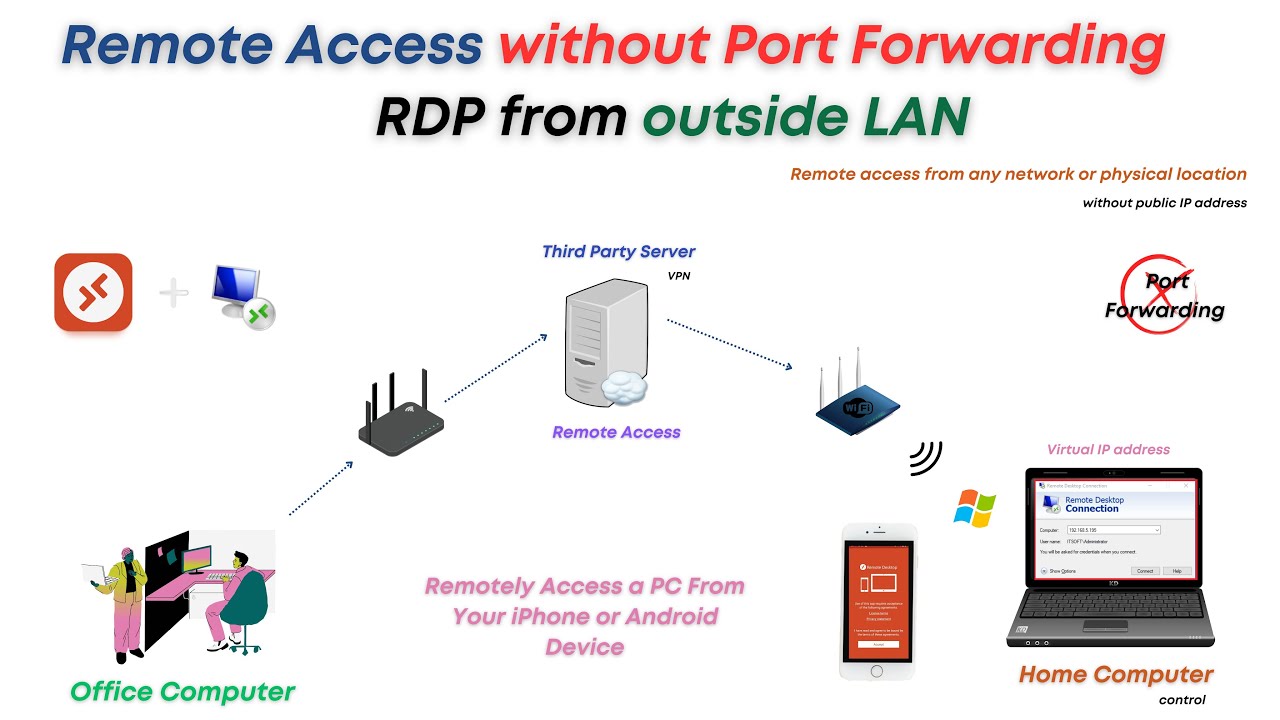

Remote access without port forwarding - RDP from outside the LAN | without public IP address

Cara Membuka Yandex di Google Chrome Tanpa VPN dan Proxy 2024

The VIETNAM WAR [APUSH Review Unit 8 Topic 8] Period 8: 1945-1980

1 2 DBMS

Unit 2 I Know I can Do It |Bahasa Inggris kelas 8 SMP Chapter 5 Embrace Yourself | Kurikulum Merdeka

5.0 / 5 (0 votes)