Investor ayyi ila chepakudadu😅

Summary

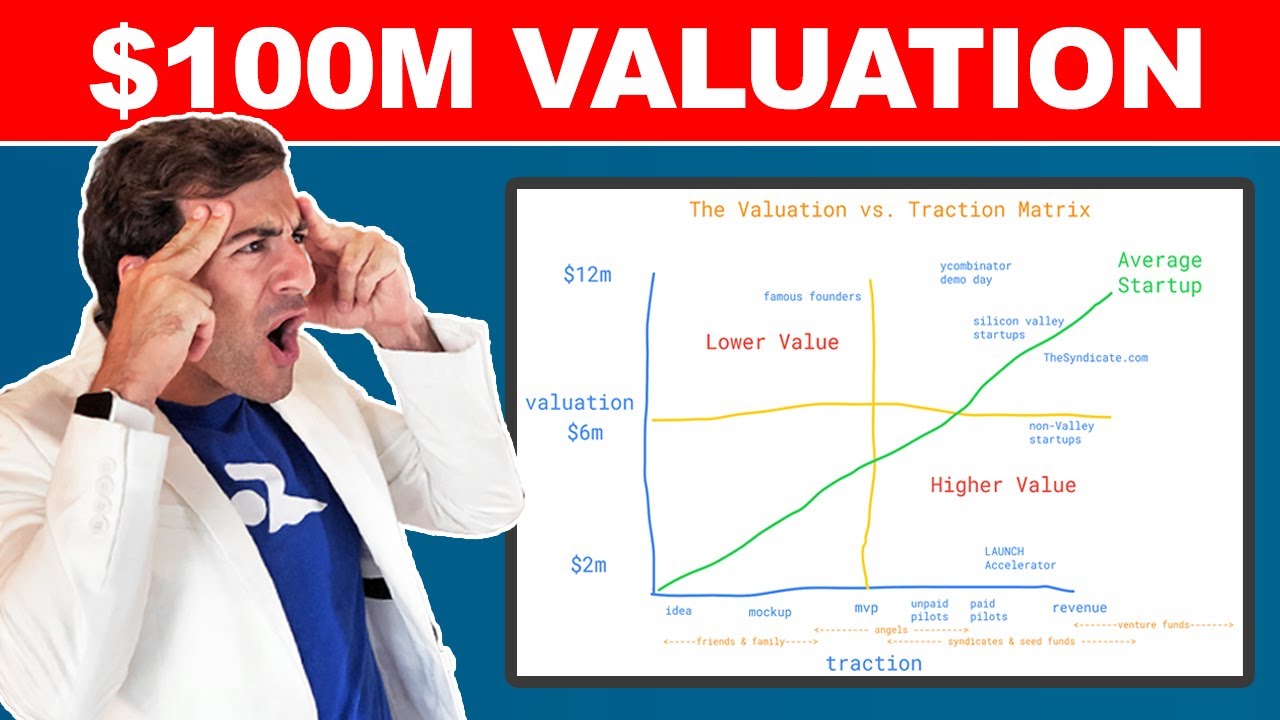

TLDRThe script discusses key insights for startup founders and investors, emphasizing the importance of avoiding unnecessary investment in the early stages. It suggests that founders should focus on scaling their businesses and optimizing unit economics rather than taking external funding. The speaker advises against diluting equity too early, especially when the company’s valuation is low, as it could lead to losing control and motivation. The message stresses the importance of strategic decision-making when managing investments to ensure long-term growth and ownership retention.

Takeaways

- 😀 Founders should be cautious when taking investment at an early stage, especially if the valuation is low.

- 😀 If an investor offers funding but the company does not need it, it may be wise to reject the investment.

- 😀 In the early stages of a startup, the founder should focus on building the company and unit economics, not just acquiring clients.

- 😀 A founder’s main goal should be balancing revenue with expenses in order to ensure the sustainability of the business.

- 😀 Taking money from investors at a low valuation can lead to significant dilution, reducing the founder’s equity in the company.

- 😀 The startup's valuation will generally be low in the early stages, which affects how much equity a founder gives away in exchange for investment.

- 😀 Founders should avoid taking investment unless they have an absolute need for funds.

- 😀 More investment at a low valuation leads to more shares being in the hands of investors, diminishing the founder's ownership and control.

- 😀 Founders should be careful not to dilute too much equity at an early stage to retain motivation and control over the company.

- 😀 High equity dilution in the early stages can lead to a lack of motivation for the founder, as their ownership share decreases significantly.

- 😀 If a company’s valuation is too low, even with a lot of investor interest, the founder may still lose control over the business.

Q & A

Why should startup founders be cautious about taking investment too early?

-Startup founders should be cautious about accepting investment too early because it could result in significant equity dilution at a low valuation, reducing their ownership and motivation to grow the business.

What does the speaker mean by 'equity dilution'?

-Equity dilution refers to the process of reducing a founder's percentage of ownership in the company by issuing more shares, typically in exchange for investment.

What is the significance of the 'right time' to accept investment according to the speaker?

-The 'right time' to accept investment is when the company needs to scale and expand significantly, not just because the investment opportunity is available.

How does a low valuation affect a startup when accepting investment?

-A low valuation means that the company is valued less, so the investor receives more equity for the same amount of money, which can dilute the founder’s ownership and control of the company.

Why might a startup founder reject an investment offer even if funds are available?

-A founder might reject an investment offer even if funds are available to avoid excessive equity dilution and to maintain more control over the company's future growth and decision-making.

What impact does taking investment at a low valuation have on the founder’s motivation?

-Taking investment at a low valuation can decrease the founder’s motivation because they may own a smaller percentage of the company and thus feel less invested in the company's future success.

What is the role of unit economics in the decision to accept investment?

-Unit economics refers to the balance between revenue generated from acquiring customers and the expenses incurred. Founders should focus on building a solid unit economics model before considering external investment.

How does early-stage company valuation affect the investor's stake?

-At early stages, the company valuation is usually low, which means investors can acquire a larger share of the company for a smaller amount of money. This can lead to significant dilution for the founder.

What should a founder focus on during the early stages of a startup instead of taking investment?

-In the early stages, founders should focus on building the business, improving unit economics, and achieving a sustainable balance between revenue and expenses rather than immediately seeking external investment.

What is the potential disadvantage for investors if the startup becomes unsuccessful?

-If the startup fails, investors could face the disadvantage of having a large stake in a company that is worth very little or nothing, making their investment a loss.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenWeitere ähnliche Videos ansehen

Startup Guide: Challenges of Being and Entrepreneur

How To Value A Startup Pre-Revenue (Valuation vs. Traction Matrix)

Founder Archetypes: The First Time Founder's Edge | Avnish Bajaj | Chandrasekhar Venugopal

How To Distribute Startup Equity (The Smart Way)

Rich Investors Vs 'Normal' Investors: The 3 Main Differences Explained | Waterfield's Soumya Rajan

How Do Billion Dollar Startups Start?

5.0 / 5 (0 votes)