History of Derivatives Trading

Summary

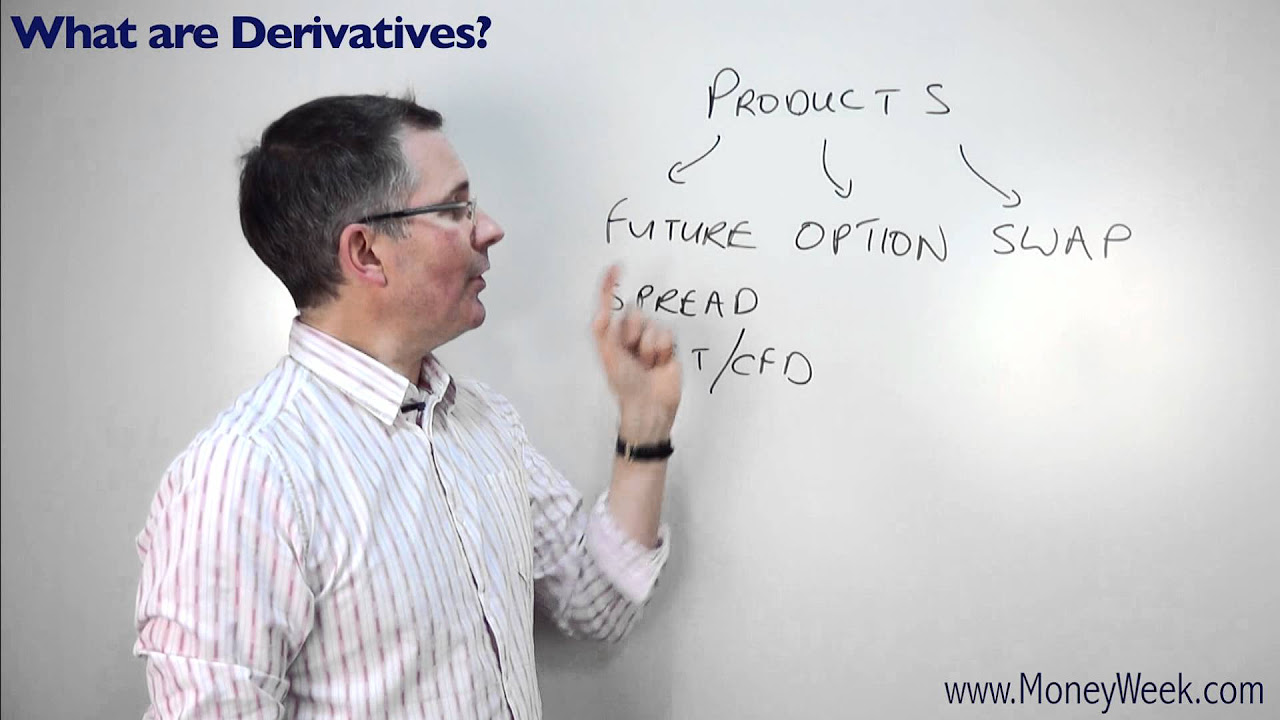

TLDRThis lesson covers the concept of derivatives, which are financial instruments used to manage risk in volatile markets. Their value is linked to underlying assets such as commodities, stocks, or interest rates. The lesson traces the history of derivatives from ancient Greece to modern futures markets, including key milestones like the Chicago Board of Trade's launch in 1848 and the growth of the Malaysian derivatives market. The script highlights the evolution of futures and options contracts, showing how they have become vital tools in global financial markets.

Takeaways

- 📈 Derivatives are financial instruments used to manage exposure in volatile markets.

- 🔗 The value of a derivative depends on the underlying asset, such as commodities, interest rates, indices, or stocks.

- 📊 Derivatives trading has significantly grown, with 46.8 billion futures and options contracts traded globally in 2020.

- 📜 Derivative-like instruments date back to ancient Greece, with the story of Thales and the olive press being an early example.

- 🌾 The modern futures market began in Chicago in 1848 with forward contracts for agricultural grains on the Chicago Board of Trade (CBOT).

- 💱 Over time, financial markets introduced currency and interest rate futures, starting in the 1970s.

- 🏛️ The Chicago Mercantile Exchange (CME) launched the first stock index futures for the S&P 500 in 1982, paving the way for stock index futures worldwide.

- 🇲🇾 The first futures exchange in Malaysia, the Kuala Lumpur Commodity Exchange (KLCE), was established in 1980.

- 📅 In 1995, the Kuala Lumpur Options and Financial Futures Exchange (KLOFFE) introduced stock index futures on the Kuala Lumpur Composite Index (KLCI).

- 🌍 Bursa Malaysia Derivatives formed a strategic partnership with CME in 2009 to expand Malaysia's derivatives offerings globally.

Q & A

What are derivatives?

-Derivatives are financial instruments used to manage exposure to volatile markets. Their value is derived from an underlying asset, such as commodities, interest rates, indices, or stocks.

How is the value of a derivative determined?

-The value of a derivative is linked to the expected future price movements of its underlying asset.

How has derivatives trading grown in recent years?

-Derivatives trading has grown extensively over the past 20 years, with a record-breaking 46.8 billion futures and options contracts traded on exchanges worldwide in 2020.

What is an example of a derivative-like instrument from ancient history?

-In ancient Greece, a derivative-like instrument is mentioned in the story of Thales, a Greek astronomer who predicted an abundant olive harvest and made deposits on all olive presses, profiting when demand for the presses surged.

Where and when did modern futures markets begin?

-Modern futures markets began in Chicago, United States, in 1848 with the trading of forward contracts for agricultural grains through the Chicago Board of Trade (CBOT).

How did derivatives evolve beyond agricultural commodities?

-As financial markets developed, futures contracts expanded to include currency and interest rate futures in the 1970s.

What role did the Chicago Mercantile Exchange (CME) play in stock index futures?

-The CME launched its first stock index futures, the S&P 500 Index Futures, in 1982, which paved the way for stock index futures worldwide.

When was the first futures exchange in Malaysia established?

-The first futures exchange in Malaysia, the Kuala Lumpur Commodity Exchange (KLCE), was established in July 1980.

What were some key developments in Malaysia's futures markets after KLCE?

-In 1995, the Kuala Lumpur Options and Financial Futures Exchange (KLOFFE) was established, offering stock index futures and options. In 1996, the Malaysia Monetary Exchange (MME) launched three-month interest rate futures.

How did Malaysia's derivatives market become unified?

-After a series of mergers, all Malaysian derivatives exchanges were unified under Bursa Malaysia Derivatives (BMD).

What was the significance of the 2009 partnership between BMD and CME?

-In 2009, Bursa Malaysia Derivatives (BMD) formed a strategic partnership with the Chicago Mercantile Exchange (CME) to enhance the global distribution of Malaysian derivatives offerings.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführen5.0 / 5 (0 votes)