The Monopolization of America | Robert Reich

Summary

TLDRThe video script addresses the alarming trend of market consolidation in the United States, where a few giant corporations like Monsanto, Luxottica, and Mainetti dominate various industries, leading to higher prices for consumers and lower wages for workers. It criticizes the lax enforcement of antitrust laws, which once protected against monopolies, and calls for a revival to prevent the concentration of economic and political power in the hands of a few, ensuring a fair market for all.

Takeaways

- 🌱 Monsanto's dominance in genetic traits for soybeans and corn gives them significant market power to charge farmers higher prices.

- 📉 Farmers are squeezed by both Monsanto's high prices and food processors' low purchase prices due to industry consolidation.

- 💵 Market consolidation doesn't lead to lower food prices for consumers but increases profits for monopolists.

- 🛒 Four largest food companies control a large portion of meat and soybean processing, indicating a lack of competition.

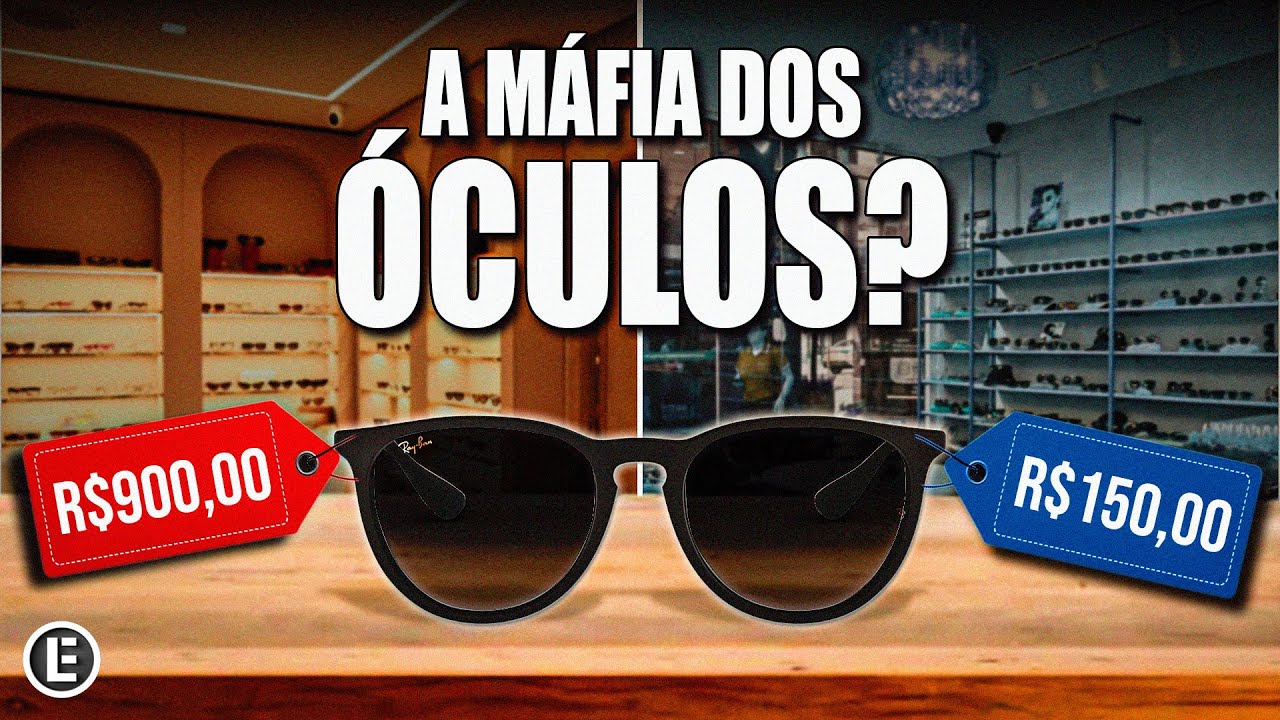

- 🪥 Even everyday products like toothpaste and sunglasses are dominated by just a few companies, reducing consumer choice.

- 👓 Luxottica's control over sunglasses and eyeglass retail outlets exemplifies the trend of market consolidation.

- 🐱 The pet food market is also consolidated, with just two companies controlling the majority of the market.

- 💊 'Pay for delay' agreements in the pharmaceutical industry cost consumers an estimated $3.5 billion annually in the US.

- 🏥 Health insurance premiums are rising partly due to consolidation in the health insurance industry.

- ✈️ Consolidation in the travel booking industry limits consumer options to primarily two companies: Expedia and Priceline.

- 📺 Cable and Internet services are dominated by four major companies, which can negatively impact consumer pricing and service.

- 💼 Massive corporate consolidation leads to lower wages as workers have fewer options for employment and less bargaining power.

- 🏛️ Antitrust laws were historically used to prevent market monopolization, but their enforcement has weakened, allowing for the current consolidation.

- 📈 The rate of new business formation has slowed since the late 1970s due to barriers created by dominant corporations.

- 🌐 Big Tech, including Google and Facebook, has become so dominant that it poses a threat to competition and potentially to democracy.

- 🛑 There's a call to revive antitrust enforcement to break up monopolies and promote a more competitive and fair market.

Q & A

Why are farmers' profits disappearing in the United States?

-Farmers' profits are disappearing due to Monsanto's ownership of key genetic traits in over 90% of soybeans and 80% of corn, allowing them to charge higher prices, and the consolidation of food processors into mega-companies that can reduce the prices they pay to farmers.

What is the impact of market consolidation on consumers and farmers?

-Market consolidation leads to higher prices for consumers and lower prices for farmers' produce, resulting in increased profits for monopolists and a redistribution of wealth and power from the majority of Americans to corporate executives and wealthy shareholders.

How does the consolidation of food companies affect the variety of products available to consumers?

-Despite the appearance of choice in the supermarket, the consolidation of food companies means that a significant portion of products and brands come from just a few corporations, reducing actual variety and potentially leading to less innovation and higher prices.

Why are 'pay for delay' agreements between drug companies and generic drug makers a concern?

-'Pay for delay' agreements, where drug companies pay generic drug makers to delay cheaper versions, are a concern because they cost consumers an estimated $3.5 billion a year and are illegal in other advanced economies but not addressed by antitrust enforcement in America.

How does the consolidation of health insurers affect health insurance premiums and deductibles?

-The consolidation of health insurers leads to fewer options and less competition, which in turn causes health insurance premiums, copayments, and deductibles to soar for consumers.

What is the connection between industry consolidation and wages?

-Industry consolidation can keep wages down, as workers have fewer choices of employers and are less able to negotiate for raises, especially when local labor markets are dominated by a single large company.

Why were antitrust laws created, and how have they changed over time?

-Antitrust laws were created in response to public anger over the economic and political power of large corporations, known as 'trusts,' that were running America. Over time, the enforcement of these laws has weakened, with a shift in focus from preventing monopolies to promoting consumer welfare, leading to less competition and more market power for a few large corporations.

How did Teddy Roosevelt's presidency influence antitrust enforcement?

-Teddy Roosevelt used the Sherman Antitrust Act to break up monopolies like the Northern Securities Company and Standard Oil Trust, setting a precedent for strong antitrust enforcement and demonstrating the government's commitment to curbing the power of large corporations.

What is the significance of Robert Bork's 'The Antitrust Paradox' on modern antitrust policy?

-Robert Bork's 'The Antitrust Paradox' argued that the Sherman Act should focus solely on consumer welfare, suggesting that mergers and large sizes create efficiencies that lower prices. This view influenced policy, leading to a decline in antitrust enforcement and an increase in market consolidation.

How does the dominance of Big Tech companies like Google and Facebook affect the economy and politics?

-The dominance of Big Tech companies in the economy and politics allows them to gain significant political influence, which can further enlarge their economic power. This concentration of power can stifle innovation, limit consumer choice, and affect how markets are organized and enforced.

Why is it important to revive antitrust laws in the current economic climate?

-Reviving antitrust laws is important to promote competition, prevent the concentration of economic and political power in the hands of a few corporations, and ensure a fair marketplace that benefits consumers and workers alike.

Outlines

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenMindmap

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenKeywords

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenHighlights

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführenTranscripts

Dieser Bereich ist nur für Premium-Benutzer verfügbar. Bitte führen Sie ein Upgrade durch, um auf diesen Abschnitt zuzugreifen.

Upgrade durchführen5.0 / 5 (0 votes)