Simulasi Transaksi Akad Musyarakah Mutanaqisah

Summary

TLDRThis video transcript outlines a detailed process of a Sharia-compliant property financing agreement, specifically Musyarakah Mutanaqisah, between Bu Hajar and Bank Syariah Alfalah. Bu Hajar, with 40% capital, partners with the bank for the purchase of a property in Mandiri Business Complex. The agreement involves shared ownership, gradual purchase of the bank's share, and rental fees (ujrah). The transcript also covers the transaction details, financial arrangements, and legal formalities, culminating in the signing of the contract and the property's transfer. It showcases a partnership that aligns with Islamic finance principles, benefiting both parties.

Takeaways

- 😀 A customer seeks financing for the purchase of a commercial property (a ruko) and is introduced to the Musyarakah Mutanakisah contract for property acquisition.

- 😀 The Musyarakah Mutanakisah contract is a partnership agreement between the customer and the bank, where both parties share the ownership of an asset, with the customer gradually purchasing the bank's portion over time.

- 😀 The customer has a 40% initial investment in the property and seeks to finance the remaining 60% through the bank's Shariah-compliant financing option.

- 😀 The financing arrangement is different from conventional loans as it involves shared asset ownership rather than just a lender-borrower relationship.

- 😀 The customer’s business is well-established, with a monthly revenue of IDR 150 million and a net profit of IDR 30 million.

- 😀 The bank proposes a 10-year repayment period, with the customer making monthly payments to gradually purchase the bank's share and pay rent (ujrah) on the bank's portion.

- 😀 The rent is based on the market value of the property, with a decreasing amount over time as the customer purchases more of the bank's portion.

- 😀 The customer will start paying approximately IDR 9.8 million per month, which will decrease as the bank's ownership portion diminishes over time.

- 😀 A notary public is involved to ensure the legal validity of the contract, with all parties agreeing to the terms, including the purchase and financing details.

- 😀 After the transaction and all payments are completed, the customer can begin using the property once the keys are handed over, typically within 3 to 7 days after the funds are transferred.

Q & A

What is Musyarakah Mutanaqisah?

-Musyarakah Mutanaqisah is an Islamic financing contract where the bank and the customer jointly own an asset. The customer contributes a portion of the capital, and the bank provides the remaining portion. Over time, the customer buys out the bank’s share, while also paying rent (ujrah) on the bank’s portion.

What are the primary components of the payment structure in this financing?

-The payment structure consists of two main components: the principal payment for purchasing the bank's portion of the property, and the rent (ujrah) paid to the bank for its share of ownership. The ujrah amount decreases as the customer buys more of the bank's share.

How does the customer’s monthly payment break down initially?

-Initially, the customer's monthly payment is a combination of the principal installment (IDR 5 million) and the ujrah (IDR 4.8 million), making the total initial payment around IDR 9.8 million per month. Over time, the ujrah amount decreases as the customer buys more of the bank's ownership.

What is the significance of the customer’s initial capital contribution?

-The customer contributes 40% of the property's price (IDR 400 million) as their capital, while the bank contributes the remaining 60%. This shared ownership is fundamental to the Musyarakah Mutanaqisah structure, where the customer gradually buys out the bank’s portion.

How does the customer gradually purchase the bank's portion?

-The customer purchases the bank's portion through monthly payments over a period of 10 years. As the customer makes these payments, their share of ownership increases, and the bank's share decreases.

What is the role of the bank in the Musyarakah Mutanaqisah agreement?

-In the Musyarakah Mutanaqisah agreement, the bank contributes to the initial purchase by providing 60% of the property’s value. The bank’s role is also to collect rent (ujrah) on its share of ownership until the customer buys it out.

How is the rent (ujrah) calculated?

-The rent (ujrah) is initially calculated based on the proportion of the bank’s ownership. For example, if the bank owns 60% of the property, the rent is calculated at 60% of the market rent value. As the customer buys more of the bank's share, the rent decreases.

What documents are required to finalize the Musyarakah Mutanaqisah transaction?

-The required documents include the agreement for Musyarakah Mutanaqisah, the property sale agreement, and other documents related to ownership transfer and financing. A notary helps formalize the agreement and ensure legal compliance.

How is the transaction finalized with the seller of the property?

-The transaction is finalized by signing a sale agreement between the customer (Ibu Hajar), the bank, and the property seller (Ibu Yusnita). The customer and the bank agree on the terms, and payment is made through a bank transfer to complete the sale.

What happens after the transaction is completed and the property is purchased?

-After the transaction is completed, the customer can begin occupying the property once the payment is confirmed. The bank also provides a schedule of the monthly payments that the customer needs to follow for the duration of the Musyarakah Mutanaqisah agreement.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

Tugas Perbankan Syariah

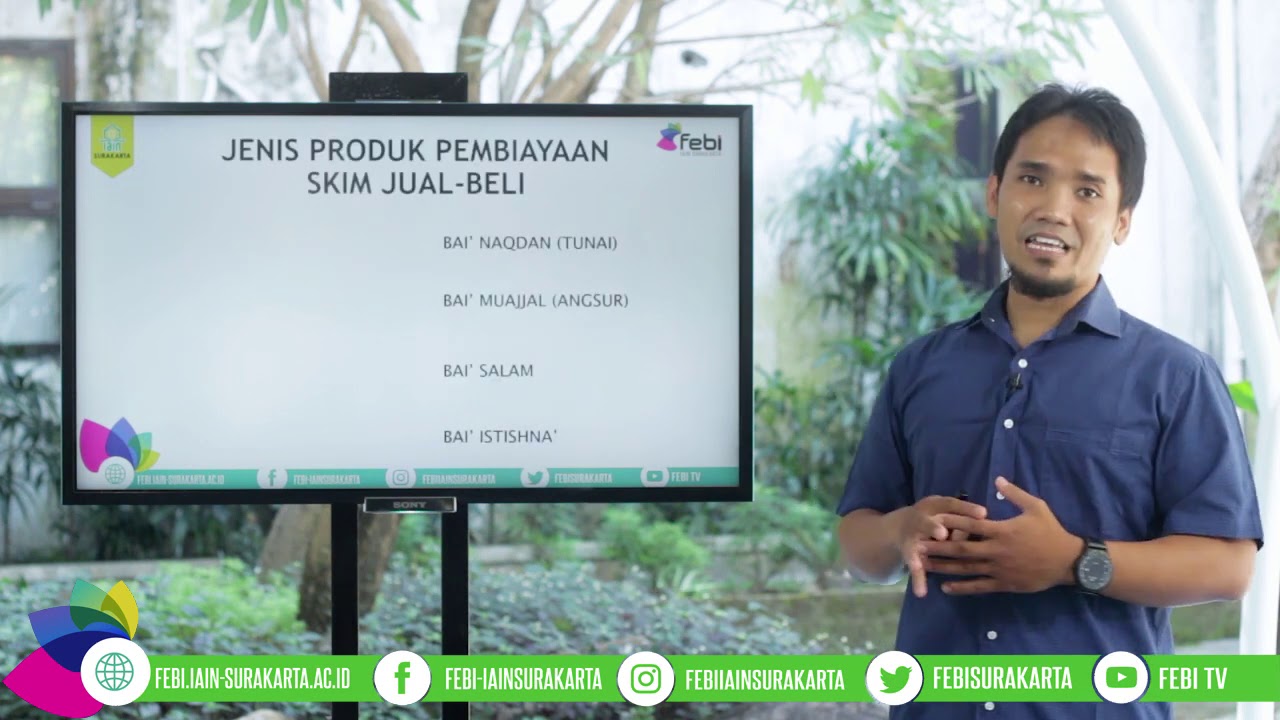

Manajemen Pembiayaan Bank Syariah Bagian 1 | Rais Sani Muharrami, M.E.I

PENGALAMAN KPR SYARIAH BSM

Dialog Virtual : KSPPS BMT Huwaiza

🔴[LIVE] Kultum Ramadhan 1447 H Oleh Ustadz Rojak, M.Pd | Kepala MIN 05 Jakarta Utara

Punya Potensi Besar, EKSyar Nasional tak Bisa Dipandang Sebelah Mata!

5.0 / 5 (0 votes)