ULIP का काला सच | Unit Linked Insurance Plan Vs Mutual Fund | Which is better investment?

Summary

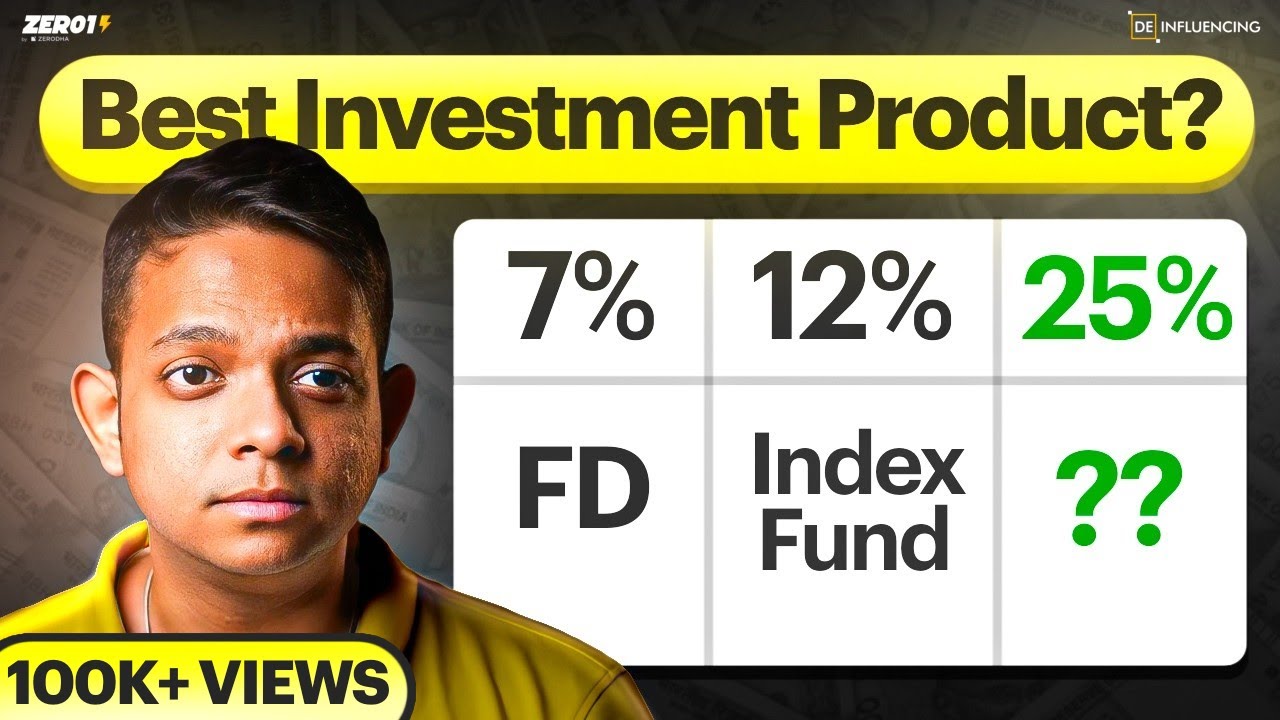

TLDRIn this video, the hosts discuss the dangers of investing in ULIPs (Unit Linked Insurance Plans) and expose them as costly and inefficient investments compared to other financial products. They reveal hidden fees, escalating mortality charges, and low returns, while advising viewers to prioritize term insurance and mutual funds instead. They also highlight how agents push ULIPs for high commissions, misleading clients about the benefits. The video serves as a cautionary guide to help viewers make better financial decisions, offering alternatives for wealth creation and tax savings.

Takeaways

- 😀 ULIPs (Unit Linked Insurance Plans) are often marketed as good investment options, but they come with hidden charges and limitations.

- 😀 Life insurance premiums should be ideally 10X of your annual income to provide adequate coverage for your family.

- 😀 Many insurance agents sell ULIPs to earn high commissions, often misleading people about the benefits and returns of these plans.

- 😀 The returns on ULIPs are often underwhelming, with hidden charges such as mortality charges, fund management charges, and premium redirection charges reducing the investment amount.

- 😀 Mutual funds are typically a better option for long-term investment, offering lower charges and better returns compared to ULIPs.

- 😀 ULIPs lock your money in for 5 years, and withdrawing before that results in no returns or poor returns, akin to a savings account.

- 😀 The charges for life insurance in ULIPs increase as you age, which makes them expensive over time, especially after the age of 36.

- 😀 ULIPs' commissions for agents are often as high as 25-30% in the first year, which means a significant portion of your money is deducted as a fee.

- 😀 Tax-saving in ULIPs may sound appealing, but there are other better tax-saving options such as EPF, PPF, NPS, and ELSS.

- 😀 If you already have a ULIP, it's advisable to discontinue it, especially if it's within the lock-in period, and explore other investment opportunities like mutual funds and term insurance.

Q & A

What is the main issue with ULIPs (Unit Linked Insurance Plans) discussed in the video?

-The main issue with ULIPs discussed in the video is that they combine life insurance and investment, but often at high costs. Agents sell them as better alternatives to mutual funds, but the returns after fees and charges are typically lower, making ULIPs an inefficient choice for many investors.

Why does the speaker advise against investing in ULIPs?

-The speaker advises against investing in ULIPs because they have high premiums, complex charges, and poor returns. ULIPs involve high mortality charges and other fees that diminish the actual investment, leading to poor financial outcomes in comparison to other investment options like mutual funds.

What is the main disadvantage of ULIPs as explained in the video?

-The main disadvantage of ULIPs is the high fees and charges that are deducted from the investment amount, including mortality charges, premium allocation charges, and other administrative fees, which significantly reduce the actual amount invested and the potential returns.

How do the returns from ULIPs compare to mutual funds?

-The returns from ULIPs are generally lower than those of mutual funds because the money in ULIPs is invested after various charges are deducted. Mutual funds, especially direct mutual funds, tend to have lower fees and better returns over the long term.

What should a person prioritize when it comes to life insurance?

-A person should prioritize term insurance, which offers high coverage at low premiums. The speaker suggests that term insurance should be at least 10 times the individual's annual income, providing adequate financial protection for their family in case of untimely death.

What is the issue with the life insurance cover provided by ULIPs?

-The life insurance cover provided by ULIPs is often insufficient relative to the premiums paid. For example, paying a high premium for a low cover amount makes it an expensive way to obtain life insurance. In contrast, a standalone term insurance policy offers better coverage at a lower cost.

Why does the speaker emphasize the importance of starting to invest early?

-The speaker emphasizes starting early because it allows investors to take advantage of compounding, which increases wealth over time. Delaying investments means missing out on significant growth opportunities, especially in the stock market and mutual funds.

What should a person do if they already have a ULIP?

-If someone already has a ULIP, they should consider discontinuing it, especially if it is still within the free lock-in period or if it's less than 5 years old. The speaker suggests switching to term insurance and mutual funds for better returns and financial security.

What are the hidden charges in ULIPs that agents often don't explain to the buyer?

-The hidden charges in ULIPs include mortality charges, premium redirection charges, fund switching charges, and surrender charges. These fees reduce the actual amount invested, making ULIPs much less profitable than other investment options.

How do agents benefit from selling ULIPs?

-Agents benefit from selling ULIPs by earning high commissions, particularly from the first-year premiums. They often push ULIPs because they receive up to 25-30% commission on the first premium, which motivates them to sell these products, regardless of whether they are in the best interest of the customer.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

If you're investing in this, it will make you poor | De-influencing

What is Insurance | What is Life Insurance and General Insurance | Different Types of Insurance

9 December 2024

O TRISTE FIM do Brasileiro que Investe na POUPANÇA

Easy To Follow Investing Plan for 2025 | Where to Invest ?

My Top 5 Worst Investments

5.0 / 5 (0 votes)