How I Analyze Futures Intra-Day | Break & Retest Flag Patterns (/ES /NQ)

Summary

TLDRIn this video, the focus is on intraday analysis of Futures contracts and how understanding key levels, chart patterns, and technical setups can enhance a trader's strategy. The speaker emphasizes the importance of monitoring pre-market highs, lows, and break-and-retest patterns. By analyzing Futures contracts, traders can predict stock movements and make more informed decisions. Practical examples are shared, showcasing setups like bear flags and EMA rejections. Overall, the video provides valuable insights for traders to refine their skills and improve their performance in both Futures and stock trading.

Takeaways

- 😀 Understanding intraday analysis of Futures contracts is essential for improving trading strategies in both Futures and individual stocks.

- 📊 Key levels like pre-market highs, previous day highs, and lows are critical for identifying market sentiment and potential price movements.

- 🔑 Break-and-retest patterns are key setups that provide entry points after the market breaks through support or resistance and retests those levels.

- 📈 The 9 Exponential Moving Average (EMA) on a 2-minute chart helps to filter out noise and identify trend reversals or continuation patterns.

- ⚠️ Bear flag patterns into the 9 EMA are reliable indicators for short opportunities, especially when price rejects the EMA and continues in the same direction.

- 🧠 Identifying demand and resistance levels at key chart points, such as the 3944 level in the video, is essential for timing trades correctly.

- 🕰️ Timing is crucial; don’t rush into trades. Wait for confirmation through clear patterns like break-and-retest or flag formations before entering a position.

- 🚀 Futures contracts, especially S&P 500 (ES) and Nasdaq Futures, significantly influence individual stocks, making them important to watch for stock traders.

- 🔄 When the market shows a rejection or break-and-retest pattern, the same movements can be expected in correlated stocks like Tesla, Amazon, and Apple.

- 📉 After entering a position, always monitor key levels like previous lows and highs, as these can act as support or resistance and determine when to exit the trade.

Q & A

What is the primary focus of today's video?

-The primary focus is on intraday analysis of Futures contracts, specifically how traders can identify key technical formations like break and retests, flag patterns, and EMA rejections to improve their trading decisions on an intraday basis.

Why is it important to track pre-market highs and previous day highs in intraday analysis?

-Tracking pre-market highs and previous day highs helps identify important levels of support and resistance. These levels are crucial for anticipating price movement and potential reversals as the market opens and throughout the trading day.

How can understanding Futures contracts influence individual stocks?

-Futures contracts, such as the S&P 500 Futures (ES), often set the tone for the broader market. Individual stocks, like Tesla or Apple, may move in response to the price action of the Futures, making it essential for traders to watch Futures contracts to predict stock price movements.

What is a 'break and retest' pattern, and why is it significant for intraday trading?

-A 'break and retest' occurs when the price breaks through a key level of support or resistance, then retests that level to confirm the break. This is significant because it often signals the continuation of the trend, providing a high-probability entry point for traders.

How does the 9 EMA help in intraday analysis on the two-minute chart?

-The 9 EMA on the two-minute chart is used to smooth out short-term price fluctuations. It helps identify trend direction and potential entry or exit points, as price typically reacts to the EMA by either rejecting or crossing it.

What is the key difference between using a one-minute chart and a two-minute chart for Futures analysis?

-A one-minute chart tends to be more noisy and volatile, which can make it harder to identify reliable patterns. A two-minute chart reduces this noise while still capturing quick price action, making it more effective for analyzing the S&P and Nasdaq Futures, especially in volatile markets.

What does a 'bear flag' pattern indicate, and how does it work in this context?

-A bear flag is a continuation pattern that forms when the price consolidates in a downward sloping channel after a strong decline. In this context, the bear flag is a sign of a potential continuation of the downward trend, and traders often use it as an entry point for short trades after the pattern is confirmed.

Why is it essential to monitor both sides of a trade (long vs. short) when marking levels like lows and highs?

-Monitoring both sides of a trade allows traders to stay flexible. If a level holds, it might indicate demand, which could lead to a potential reversal or long trade. On the other hand, if the level breaks, it might indicate further downside, leading to a short trade. This dual approach helps traders make informed decisions.

What role does the 3944 level play in today's analysis and how was it used in trading?

-The 3944 level was identified as a key low for the day. It was used as a reference point for potential support and resistance. When the market broke this level, it signaled a possible short opportunity, and later, when the price retested it, traders were able to enter a short position once the rejection confirmed the trend.

How can volatility candles impact intraday trading decisions, and what should traders do in such situations?

-Volatility candles can cause rapid, unexpected price movements. In such situations, traders should be cautious about taking positions, as these candles may not follow typical patterns like break and retest or flag formations. It's important to wait for price action to stabilize before making trading decisions.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

Crypto Swing Trading Strategy Tutorial (Step-by-Step Guide)

Padrões de Reversão

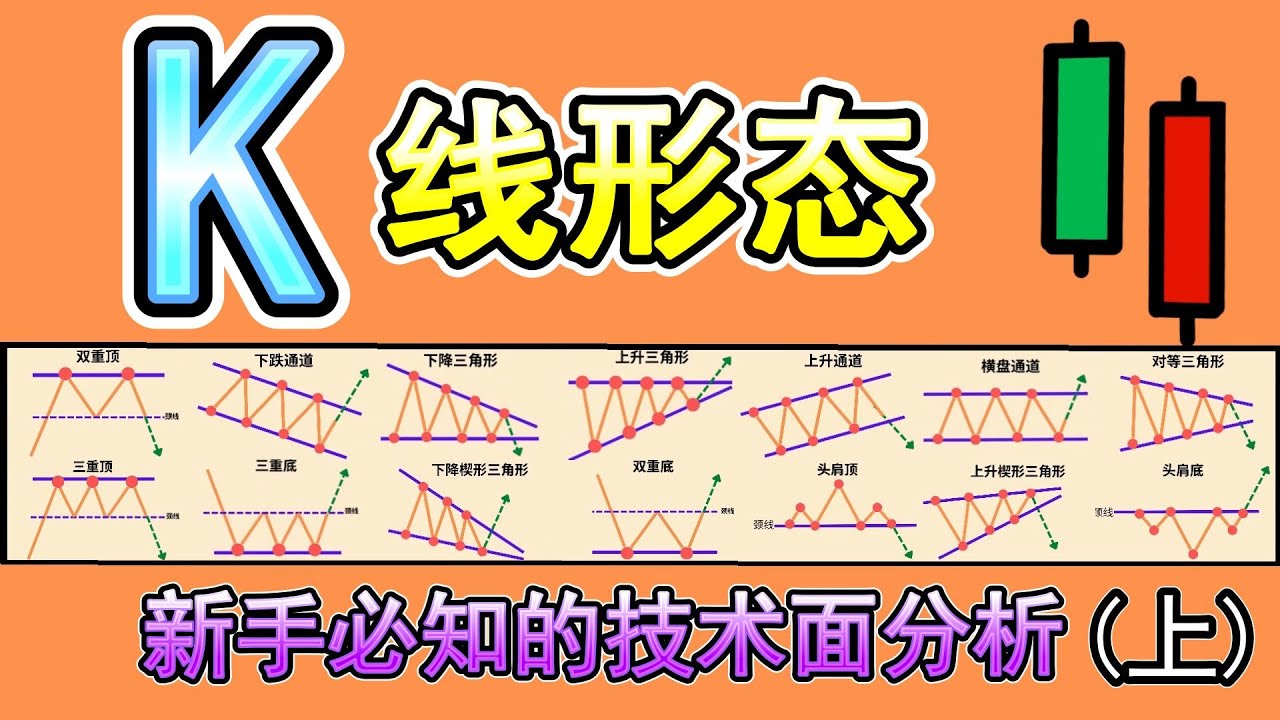

【K线形态 技术面分析】(上)你必知的18种K线形态完整教学|K线形态交易策略大公开|技术分析新手入门教学|专业交易员必备的K线形态技术分析|Chart Pattern Analysis

ĆWICZENIE KTÓRE ZMIENIŁO MÓJ TRADING

تحلیل درخواستی DOGE - LINK - XRP - AVAX - ETHFI - NOT - ETH - DOT - SKL - MAGIC - BONK

$10,000 Worth of Trading Education in 41 Minutes

5.0 / 5 (0 votes)