Patlama Yapacak Hisseler Nasıl Bulunuyor Eğitimi | Patlama Yapacak Hisseleri Siz Bulun (2)

Summary

TLDRThis video script is a comprehensive guide on identifying stocks with potential for significant price increases. It covers various financial analysis techniques, including examining financial tables, balance sheets, and income statements. The narrator emphasizes the importance of assessing a company's financial health through metrics like net profit, operational cash flow, and leverage ratios. The script also touches on the significance of comparing these metrics with industry averages to spot undervalued stocks. The video promises to delve deeper into detailed analysis, including sector-based reviews and management evaluations, to help viewers make informed investment decisions.

Takeaways

- 😀 The video is aimed at helping viewers identify stocks that have potential to explode in value.

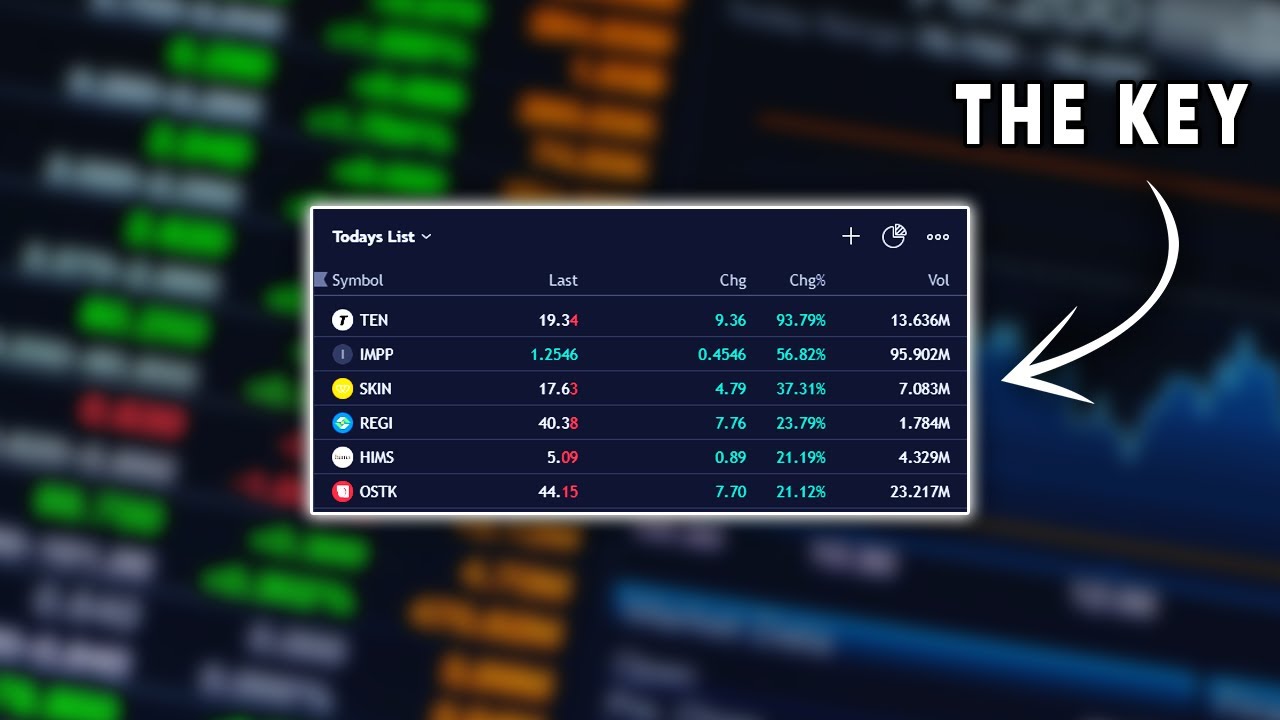

- 📈 The presenter discusses the importance of analyzing financial tables and using tools like radar features to find promising stocks.

- 📊 The video emphasizes the need to look at key financial metrics such as net profit, main business income, and investment expenditures.

- 🔍 The presenter mentions the use of free educational resources and encourages viewers to subscribe and like the channel for more content.

- 📝 The script includes a detailed walkthrough of analyzing a company's financial health, including looking at assets, liabilities, and profitability.

- 📉 The video highlights the importance of understanding a company's financial ratios and comparing them to industry averages.

- 💹 The presenter discusses the potential of a specific company, MW, based on its financial performance and industry comparison.

- 📋 The script suggests that investors should be cautious about companies with high leverage ratios and low cash flow.

- 📊 The video also touches on the analysis of a company's balance sheet, focusing on changes in assets and liabilities over time.

- 📈 The presenter encourages viewers to use the insights from the video to make informed investment decisions and to look for stocks with high potential for growth.

Q & A

What is the main topic of the video?

-The main topic of the video is about finding stocks that have the potential to explode in value, with a focus on financial analysis and investment strategies.

What does the speaker suggest doing before starting the video?

-The speaker suggests subscribing to the channel, liking the video, and turning on notifications to stay updated with the latest content.

What are some of the financial metrics discussed in the video?

-The video discusses financial metrics such as net profit, operating profit, financial debt, net debt, and free cash flow.

What is the significance of 'PTT' mentioned in the script?

-PTT likely refers to the Public Disclosure Platform, where financial statements and other corporate information are disclosed, and it's used for analyzing the companies' financial health.

What does the speaker mean by 'fit renkler'?

-The term 'fit renkler' refers to the colors used in financial tables to indicate the performance of certain financial metrics, such as red for losses and green for profits.

What is the importance of 'fiili dolaşım oranı' in the analysis?

-The 'fiili dolaşım oranı' or 'free float ratio' is important as it indicates the portion of a company's shares that are available for trading in the market, affecting liquidity and potential volatility.

What does the speaker suggest about the company's financial health based on the 'öz kaynaklar' and 'borçlar'?

-The speaker suggests that a company with increasing 'öz kaynaklar' (own resources) and decreasing 'borçlar' (debts) is in a healthier financial position, which could be a positive sign for potential investors.

What is the role of 'faaliyet raporları' in the analysis?

-The 'faaliyet raporları' or 'activity reports' play a crucial role as they provide detailed insights into a company's operations, management decisions, and financial performance over a period.

Why does the speaker emphasize the importance of 'nakit akış tablosu'?

-The 'nakit akış tablosu' or 'cash flow statement' is emphasized because it shows how cash moves in and out of a business, which is a key indicator of the company's liquidity and financial health.

What does the speaker suggest about the relationship between 'kaldıraç oranı' and the sector average?

-The speaker suggests that a company with a 'kaldıraç oranı' or 'leverage ratio' that is better than the sector average might be a sign of more efficient capital structure and could be a positive indicator for investors.

What is the speaker's approach to analyzing the 'giderler ve gelirler' of a company?

-The speaker's approach to analyzing 'giderler ve gelirler' or 'expenses and revenues' involves comparing them to understand the company's profitability margins and to identify any trends or anomalies in the financial performance.

Outlines

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنMindmap

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنKeywords

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنHighlights

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنTranscripts

هذا القسم متوفر فقط للمشتركين. يرجى الترقية للوصول إلى هذه الميزة.

قم بالترقية الآنتصفح المزيد من مقاطع الفيديو ذات الصلة

How to Find Upper Circuit Stocks ? Globus Spirits Share News

How To Find Stocks To Day Trade

5 WORST Mistakes Stock Market Investors Make!

MAKE CONSISTENT MONEY BY USING THIS INDICATOR. MUST WATCH WITH SCREENER. #ADX, #INDICATOR, #SCREENER

Come FARE l'ANALISI FONDAMENTALE di un'AZIONE PARTENDO da ZERO | Lezione 6

How to invest 1Cr for (15-20%) growth in 2025? [Contrarian Strategies] | Akshat Shrivastava

5.0 / 5 (0 votes)