方脸说:详细解读中国一季度经济数据,GDP增速5.3%是否代表复苏?数据透露出的中国经济增长动力以及困境丨通缩丨供需不平衡丨外贸依赖来加剧

Summary

TLDRIn this video, the speaker analyzes China's recently released economic data for the first quarter, highlighting a surprising 5.3% GDP growth, which exceeded all forecasts. The discussion includes discrepancies in GDP calculations, revealing underlying issues like deflation and weak consumer spending. The analysis also examines China's manufacturing and export-driven growth amidst internal economic challenges and global political pressures. The speaker critiques the sustainability of China's economic model and warns of potential future difficulties if the current trajectory continues.

Takeaways

- 😀 China's first-quarter GDP growth rate reached 5.3%, surpassing predictions from major financial institutions.

- 📊 The GDP growth rate exceeded forecasts from Reuters (4.6%), Bloomberg (4.7%), and Nikkei (4.5%).

- 💡 The apparent discrepancy in GDP figures between quarters is due to differences between nominal GDP growth and constant price GDP growth.

- 📉 China's economy faces deflation, indicated by a negative GDP deflator.

- 💸 Consumer spending is weak, with retail sales growth of 4.7%, below pre-pandemic levels.

- 🏠 The real estate sector is struggling, with significant drops in sales area and value.

- 🏭 Industrial output rose by 6.1%, driven by manufacturing and exports.

- 🌍 Export growth played a crucial role in GDP growth, with a notable increase in exported goods, especially electric vehicles.

- ⚖️ The imbalance between production and consumption is evident, with manufacturing outpacing consumer demand.

- 🌐 China's dependence on exports has increased, making it vulnerable to international trade dynamics and potential trade conflicts.

Q & A

What is the reported GDP growth rate for China's first quarter, and how does it compare to predictions?

-China's first-quarter GDP growth rate was reported at 5.3%, significantly exceeding predictions from major media and financial institutions, such as Reuters (4.6%), Bloomberg (4.7%), and Nikkei (4.5%).

What are the two types of GDP growth rates discussed in the script, and how do they differ?

-The script discusses nominal GDP growth rate and constant price GDP growth rate. The nominal GDP growth rate is calculated by directly comparing the GDP values from two periods, while the constant price GDP growth rate adjusts for price changes (inflation or deflation).

Why is there a discrepancy between the nominal GDP growth rate and the constant price GDP growth rate in China?

-The discrepancy arises because the constant price GDP growth rate accounts for price changes. In China's case, deflation (falling prices) means that while nominal GDP grew by 3.96%, adjusting for deflation results in a higher constant price GDP growth rate of 5.3%.

What major economic issue does the GDP deflator indicate for China?

-The GDP deflator indicates that China is experiencing deflation, as evidenced by a negative GDP deflator, which reflects falling prices.

How did China's stock market react to the announcement of the 5.3% GDP growth rate?

-China's stock market reacted negatively, with the main index struggling to stay above 3,000 points, and a majority of stocks falling, indicating skepticism about the GDP data.

What are some key challenges facing China's economy, as revealed by the first-quarter data?

-Key challenges include deflation, insufficient consumer spending, and a struggling real estate market with record declines in sales area and revenue.

What sector showed significant growth in China's first quarter, according to the script?

-China's manufacturing sector showed significant growth, with industrial added value increasing by 6.1% year-on-year, outperforming overall GDP growth and retail sales.

What is the primary driver of China's GDP growth in the first quarter?

-The primary driver of China's GDP growth in the first quarter was exports, which saw substantial increases despite a weaker domestic consumption.

What concerns are raised about China's reliance on exports for economic growth?

-Concerns include the sustainability of export growth given global trade tensions, potential anti-dumping measures from other countries, and the risk of an economic downturn in key markets like the US and EU.

What political and economic factors could impact China's economic performance in the second half of the year?

-Political factors include China's ability to manage trade relations and mitigate anti-dumping measures. Economic factors involve the potential global economic slowdown and how it could affect China's export-driven growth model.

How has the COVID-19 pandemic affected the balance between production and consumption in China?

-The COVID-19 pandemic led to increased production supported by government subsidies, while consumer spending lagged due to a lack of substantial direct financial support for individuals, creating a supply-demand imbalance.

What potential long-term issues are highlighted if China's current economic strategy continues?

-Long-term issues include persistent deflation, over-reliance on low-cost exports, reduced consumer purchasing power, and an economic structure that fails to improve living standards despite GDP growth.

What does the script suggest about the relationship between China's GDP growth and the quality of life for its citizens?

-The script suggests that despite a high GDP growth rate, the quality of life for citizens has not improved proportionately, primarily due to low consumer spending and purchasing power.

What historical comparisons are made regarding China's current economic deflation?

-The script compares the current deflation to previous instances in 1997, 2008, and 2015, noting that the present deflationary period is the most severe since 1997.

What is the potential impact of an economic crisis in the US or EU on China's economy?

-An economic crisis in the US or EU could severely impact China's export-driven growth, leading to greater economic instability and exacerbating existing deflationary pressures.

What does the script suggest about the future of China's real estate market?

-The script suggests that China's real estate market is unlikely to recover soon, with continued declines in sales and investment, and describes the market as being in an 'L-shaped' bottom, indicating prolonged stagnation.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

THIS Crypto Bull Run Will Be NOTHING Like The Last One!

US Economy Just Went Negative — Here's What Really Happened

China’s Economic Growth Comes in Worse Than Expected | GDP Grow only by 4.7% | Adding Pressure on Xi

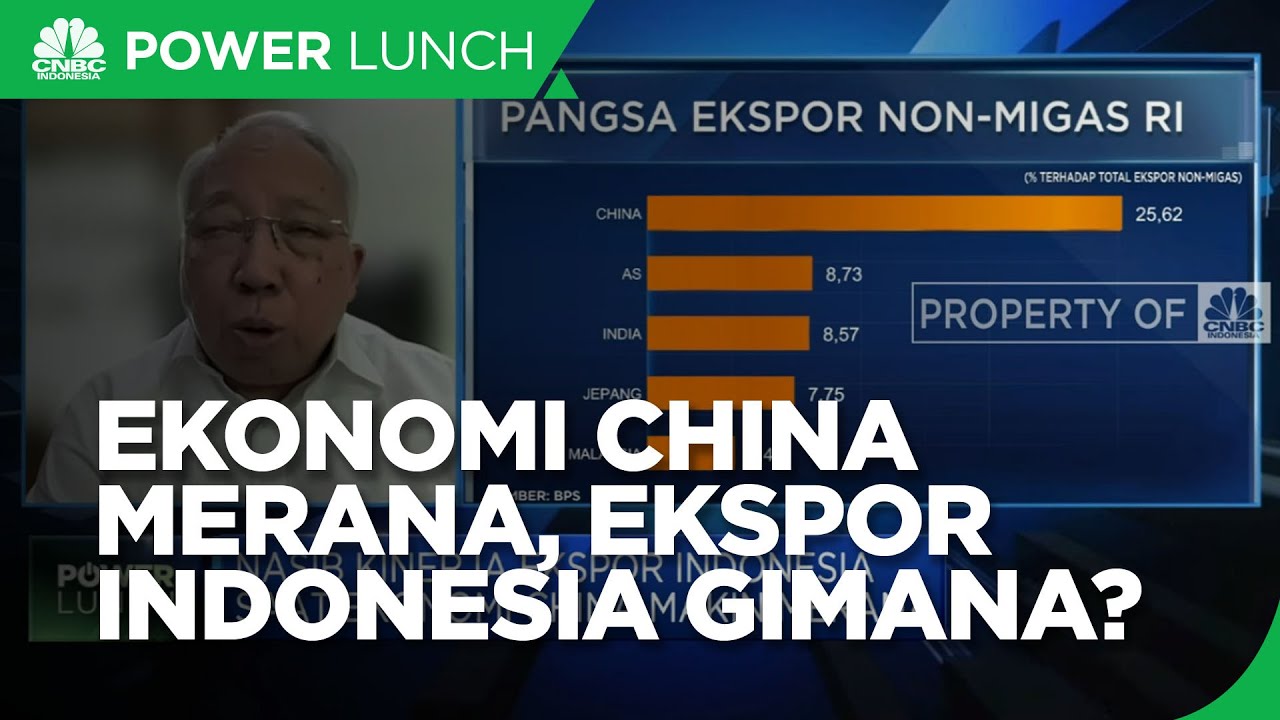

Ekonomi China Merana, Nasib Ekspor Indonesia Bagaimana?

US-China Trade War | Trump Slaps 245% Retaliatory Tariffs On Chinese Goods | The World Report

Course Member Live December 17, 2024

5.0 / 5 (0 votes)