We’re On the Cusp of Civil War and WW3; “Facing Real Risk,” Warns Pentagon Advisor

Summary

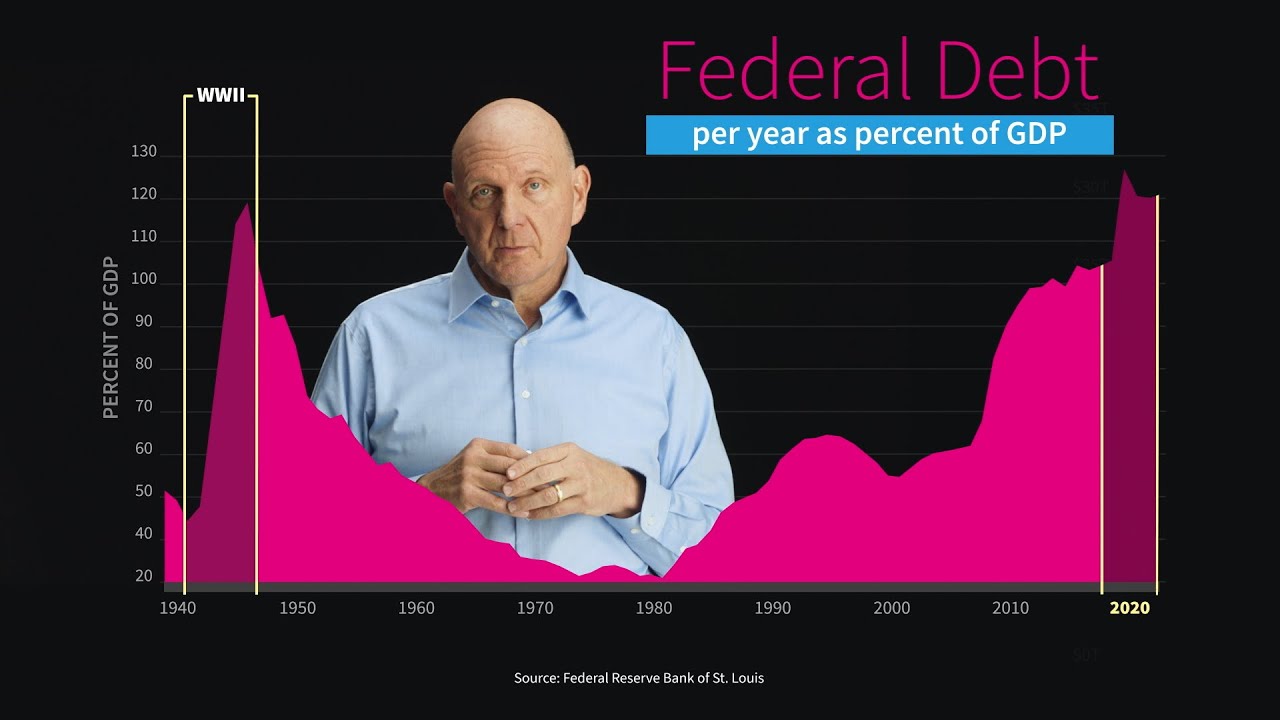

TLDRIn this enlightening episode of the Daniela Camboni Show, economic expert Kevin Freeman discusses the perils of America's escalating national debt, now nearing a staggering $35 trillion. Freeman delves into the implications of excessive money printing, the abandonment of the gold standard, and the rise of financialization, warning of the potential for economic collapse and societal unrest. Highlighting the urgency of a 'great reset' and the introduction of Central Bank Digital Currencies (CBDCs), Freeman explores the constitutional remedy of returning to gold and silver as practical currency. With a blend of historical insights and forward-looking strategies, Freeman offers a path to avert fiscal disaster and restore economic stability.

Takeaways

- 💸 The national debt of the United States is nearing $35 trillion, and the current pace of borrowing is considered unsustainable by economic experts.

- 🌍 Kevin Freeman discusses the threat of BRICS (Brazil, Russia, India, China, and South Africa) forming an alliance that could challenge the dominance of the US dollar.

- 📉 Central Bank Digital Currencies (CBDCs) are highlighted as a significant shift in monetary policy, with the potential for government control over individual spending.

- 🏛️ Freeman argues that the move away from a manufacturing-based economy to a financialized one has widened the wealth gap in America.

- 📚 His book 'Pirate Money' suggests a return to gold and silver as a hedge against the potential collapse of fiat currency.

- 🔍 The Great Reset is discussed as a controversial topic, with implications of significant changes to property ownership and national sovereignty by 2030.

- 💹 Inflation and its effects on the wealth gap are scrutinized, with a historical perspective on how excessive money printing can lead to economic instability.

- 🌏 The geopolitical implications of currency wars and the potential decline of the US dollar's dominance are explored.

- 📈 Freeman emphasizes the historical cycle of empires and economies, suggesting that America could be nearing a critical juncture in its economic and political dominance.

- 🙏 Concluding on a note of hope, Freeman calls for a return to constitutional principles and faith-based optimism to navigate future economic challenges.

Q & A

What is the primary concern Kevin Freeman discusses regarding America's financial state?

-Kevin Freeman is concerned about America's ballooning national debt, which is nearing a staggering 35 trillion, describing the country as wading into fiscal quicksand.

How does Kevin Freeman relate inflation to wealth disparity?

-Freeman explains that inflation creates a wealth gap because when excess money is produced relative to economic growth, it leads to inflation, which disproportionately harms the poor, widening the wealth disparity.

What does Kevin Freeman suggest is the impact of leaving the gold standard on the U.S. economy?

-Freeman suggests that leaving the gold standard in 1971 led to the financialization of the U.S. economy, shifting focus from manufacturing to finance, and directly correlated with the rise in national debt and inflation.

What is Kevin Freeman's view on Central Bank Digital Currencies (CBDCs)?

-Freeman views CBDCs as potentially dangerous because they give governments control over what people can do with their money, citing privacy and freedom concerns associated with such centralized control.

What solution does Kevin Freeman propose for the U.S. economic situation?

-Freeman proposes a return to using gold and silver as practical everyday currency, suggesting this could shield citizens from monetary collapse and maintain economic stability.

Why does Kevin Freeman believe other nations are targeting the U.S. dollar?

-Freeman believes other nations are targeting the U.S. dollar to reduce their dependency on it, driven by a desire to challenge U.S. economic dominance and avoid the repercussions of U.S. sanctions and financial policies.

What is Freeman's perspective on the potential for a World War?

-Freeman acknowledges the risk of World War III, noting that current global tensions could escalate into large-scale conflict, drawing parallels with historical events that led to previous world wars.

How does Kevin Freeman relate the concept of 'pirate money' to economic solutions?

-Freeman uses the concept of 'pirate money' to describe a return to gold and silver as the basis for currency, arguing that this would align with constitutional principles and provide a more stable economic foundation.

What does Kevin Freeman say about the relationship between government debt and the economy?

-Freeman emphasizes that the U.S. government's unsustainable debt path, highlighted by a significant increase in recent years, poses a critical risk to the economy, potentially leading to a financial crisis.

What does Freeman suggest is the future of money?

-Freeman suggests that the future of money will involve significant changes, potentially moving towards digital currencies or alternative forms of money like gold and silver, reflecting a shift away from traditional fiat currencies.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

The US Debt Crisis Will Affect Everyone - Including You

The Great Melt-Up Will Strike The USA: My Advice to You

Why The U.S. Won’t Pay Down Its Debt

Just the Facts About the US Federal Budget: Steve Ballmer Talks Through the Numbers

Почему США никогда не погасят свой Госдолг

Defisit APBN Melebar Per-Agustus 2024 - [Metro Siang]

5.0 / 5 (0 votes)