Les 8 Étapes pour Devenir Millionnaire en 2024 (Guide Complet)

Summary

TLDRIn this video, the speaker emphasizes the importance of focusing on cash flow as a key metric for business success. They discuss how profitable businesses can reinvest their earnings to fuel growth, whether by expanding operations or diversifying investments like real estate or the stock market. Additionally, the video highlights the potential for a business to be sold for a multiple of its annual profits once it becomes profitable and client-satisfaction is high. The speaker encourages viewers to take productive action, implement a 90-day action plan, and strategically invest to grow both personally and financially.

Takeaways

- 😀 Focus on cash flow: Cash flow is the most important metric to track in any business. It's the money you generate minus the expenses, and it determines if your business is truly profitable.

- 💡 Reinvest profits wisely: If your business is generating cash flow, reinvest the money into the business only if it will be profitable. If not, consider external investments like stocks or real estate.

- 📉 Don't rely on unsold inventory: Avoid tying up money in stock that doesn't sell well. If you're not selling products fast enough, your business may not be profitable.

- 💪 Prioritize a scalable business model: A business that is scalable and can generate steady cash flow is more likely to grow successfully and sustainably.

- ⚖️ Understand risk: Only make investments that you believe are safe and have a high chance of success, like restocking popular products in e-commerce or hiring salespeople when you have consistent demand.

- 💼 Business models should be efficient: Whether freelancing or running a business, track and optimize the income generated relative to the money spent on ads or other operational expenses.

- 🧑💻 Track profits and losses: It’s important to stay on top of your cash flow regularly. A clear understanding of money coming in and out is crucial to making informed decisions about business strategies.

- 💸 Diversify investments: Once your business generates a good cash flow, consider diversifying your investments, either into real estate or the stock market, depending on your preferences and time availability.

- 🔑 Business valuation matters: A profitable business with solid customer satisfaction and effective processes can eventually be sold for a significant profit. Plan long-term for potential business exits.

- 📊 Efficient time management is key: Invest your time and money wisely to avoid burnout or overcomplicating processes. Simplify tasks where possible and focus on making steady, informed progress.

Q & A

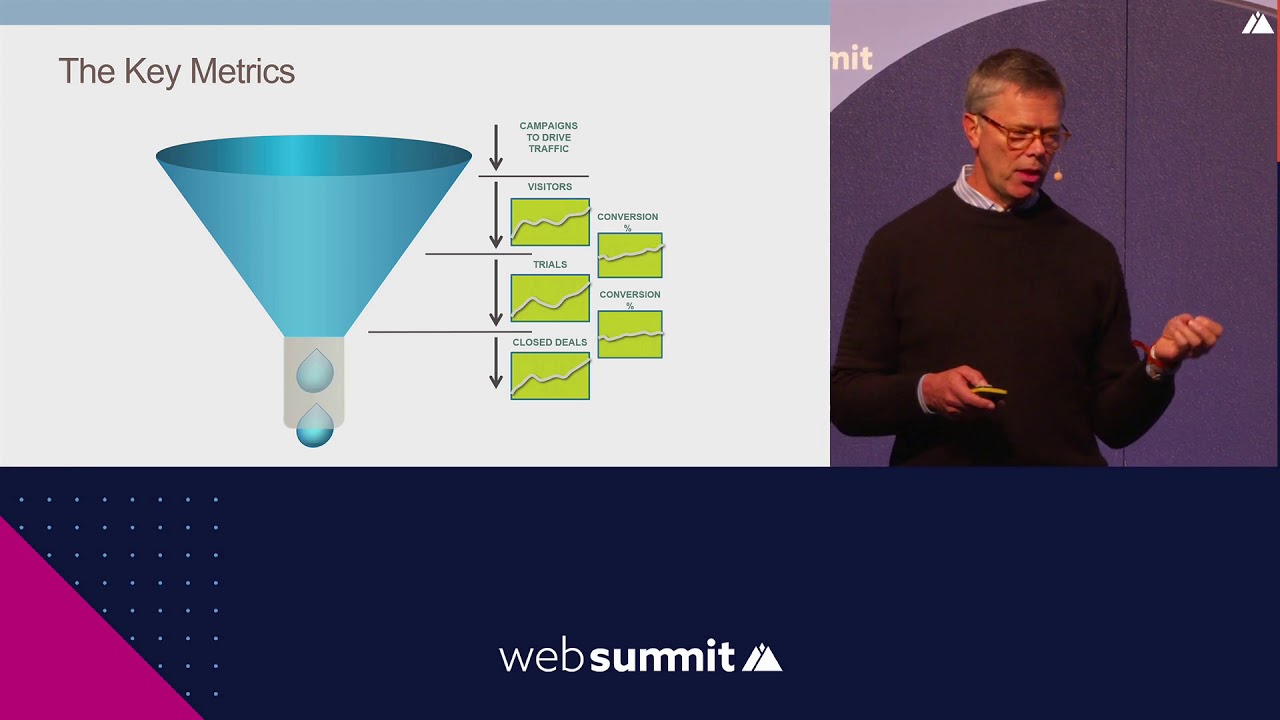

What is the most important metric to focus on when managing a business?

-The most important metric to focus on is cash flow. It shows the difference between the money coming in and going out, helping you understand how profitable the business is.

How can you invest in your business to ensure it grows profitably?

-You should reinvest in your business only if you are sure it will yield returns. For example, if you're selling products successfully, reinvesting in stock or expanding your team can be a good choice.

What is the key to knowing whether a business investment will be profitable?

-The key is having evidence that the business can generate profit from the investment, such as customer demand for your products or services, and knowing that the cost of investment can be covered by the returns.

What should you do if your business isn't generating enough profit to reinvest?

-If your business is not profitable enough to reinvest, it may indicate that your offer isn't compelling enough or is priced too low. In this case, focus on improving profitability before considering reinvestment.

Why is cash flow considered a 'no bullshit' metric?

-Cash flow is considered a 'no bullshit' metric because it's a clear, objective indicator of your business's financial health. It directly shows how much money is coming in and how much is being spent.

How should you decide whether to reinvest cash flow back into your business?

-Reinvest your cash flow only if you're certain it will generate a return. For example, if your e-commerce site is consistently sold out and you know your stock will sell, it's a safe investment.

What are some ways to invest profits from your business if you're not sure about reinvesting them into the business?

-If you're uncertain about reinvesting profits back into your business, consider investing them in real estate or the stock market. Both are good options for diversifying and growing wealth.

What is the benefit of delegating tasks and creating processes in a business?

-Delegating tasks and creating processes help scale the business by freeing up your time and ensuring operations run smoothly. This can increase efficiency and profitability, making the business more valuable in the long run.

What is business valuation, and how does it relate to long-term success?

-Business valuation is the process of determining how much your business is worth based on its profitability, customer satisfaction, and scalability. A well-managed business with strong cash flow and systems in place can be sold for multiple times its annual profit.

How can investing in the stock market or real estate help you grow your wealth outside of the business?

-Investing in the stock market or real estate allows you to grow your wealth passively and diversify your assets. While real estate might require more time and effort, it can offer higher returns, while the stock market is quicker and easier for growing wealth consistently.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)