Talking about money – B1 English Listening Test

Summary

TLDRThe transcript features a series of personal stories about individuals navigating financial challenges. Joseph discusses saving for a bike without taking a loan, while Taylor highlights the convenience of using cards for purchases. Dina shares how she helped a friend avoid a high-interest loan, and Liam talks about the strain of rising mortgage payments. Ben reflects on the importance of budgeting for emergencies, and Sophie recounts the difficulties of lending money to family. Together, these stories emphasize the complexities of managing money, from saving to lending, and the impact of financial decisions on relationships.

Takeaways

- 😀 Joseph is saving money to buy a new bike and prefers to avoid loans or credit cards, even though it’s hard to save.

- 😀 Taylor exclusively uses cards for all payments now, finding them more convenient than cash, which is rarely accepted anymore.

- 😀 Dina faced unexpected medical expenses and couldn’t afford rent, so her friend lent her money to avoid high-interest loans.

- 😀 Liam struggles with high mortgage payments, leaving little room for social activities or luxuries like dining out or holidays.

- 😀 Ben had to use his credit card for an unexpected car repair, and now plans to save for emergencies in the future.

- 😀 Sophie regrets lending money to her cousin, who hasn't paid it back yet, and now refuses to lend more until the debt is cleared.

- 😀 Joseph prefers saving through tips in a jar rather than relying on borrowing money, even if it’s slow progress.

- 😀 Taylor notes that many places now accept cards exclusively, even street performers, as cash use declines.

- 😀 Dina's experience highlights the risks of high-interest loans and the importance of having friends who can offer financial help in times of need.

- 😀 Liam's financial strain from mortgage payments makes it hard to afford anything beyond the essentials, such as his home.

- 😀 Sophie’s experience with lending money to family shows that mixing finances with personal relationships can lead to conflicts.

Q & A

Why does Joseph prefer saving money for a bike instead of taking a loan?

-Joseph prefers saving money because he does not want to borrow money or use a credit card. He believes saving is better than taking on debt, even though it can be challenging due to his expenses.

How has Taylor's approach to paying for purchases changed over time?

-Taylor used to withdraw cash or write checks for shopping, but now exclusively uses cards for all purchases, even small ones like coffee. This shift is due to the convenience of cards and the fact that many places no longer accept cash.

How did Dina manage her unexpected medical expenses?

-Dina couldn't afford her rent and was considering taking a loan. However, Joseph lent her the money from his savings to help her avoid high-interest rates, offering to let her pay him back when she was able to.

What financial challenge is Liam facing with his mortgage?

-Liam's mortgage payments have increased significantly, taking up a large portion of his salary. As a result, he struggles to afford other expenses, like dining out or vacations, and cannot buy new things for his home.

How did Ben handle an unexpected car repair cost?

-Ben had to use his credit card to pay for an expensive car repair, as he hadn't saved money for emergencies. He plans to pay it back with his next paycheck and has learned the importance of budgeting for unexpected expenses in the future.

What is Sophie's experience with lending money to family?

-Sophie lent money to her cousin but has not been repaid yet. When her cousin asked for more money, Sophie refused until the original debt was cleared. This situation has caused a rift in their relationship, leading Sophie to believe that mixing money with family or friends can cause issues.

Why does Joseph find it difficult to save money?

-Joseph finds it tough to save money because he has many expenses to cover, and he does not earn a lot as a waiter. Despite this, he continues to put tips into a jar to save for a bike.

How does Taylor feel about using cash versus cards?

-Taylor finds using cards much more convenient than carrying cash, as many places no longer accept cash. This has led Taylor to exclusively use cards for purchases, even for small items.

How did Dina react when Joseph helped her with money?

-Dina was likely relieved when Joseph helped her by lending money. Although the script doesn't explicitly mention her feelings, her situation was dire, and Joseph's assistance helped her avoid a loan with high interest rates.

What lesson did Ben learn after using his credit card for the car repair?

-Ben learned that it's essential to set aside money for emergencies in his budget. He now plans to save for unexpected expenses to avoid relying on credit cards in the future.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

Cerpen Islami | RIBA || The Crew [FILM PENDEK]

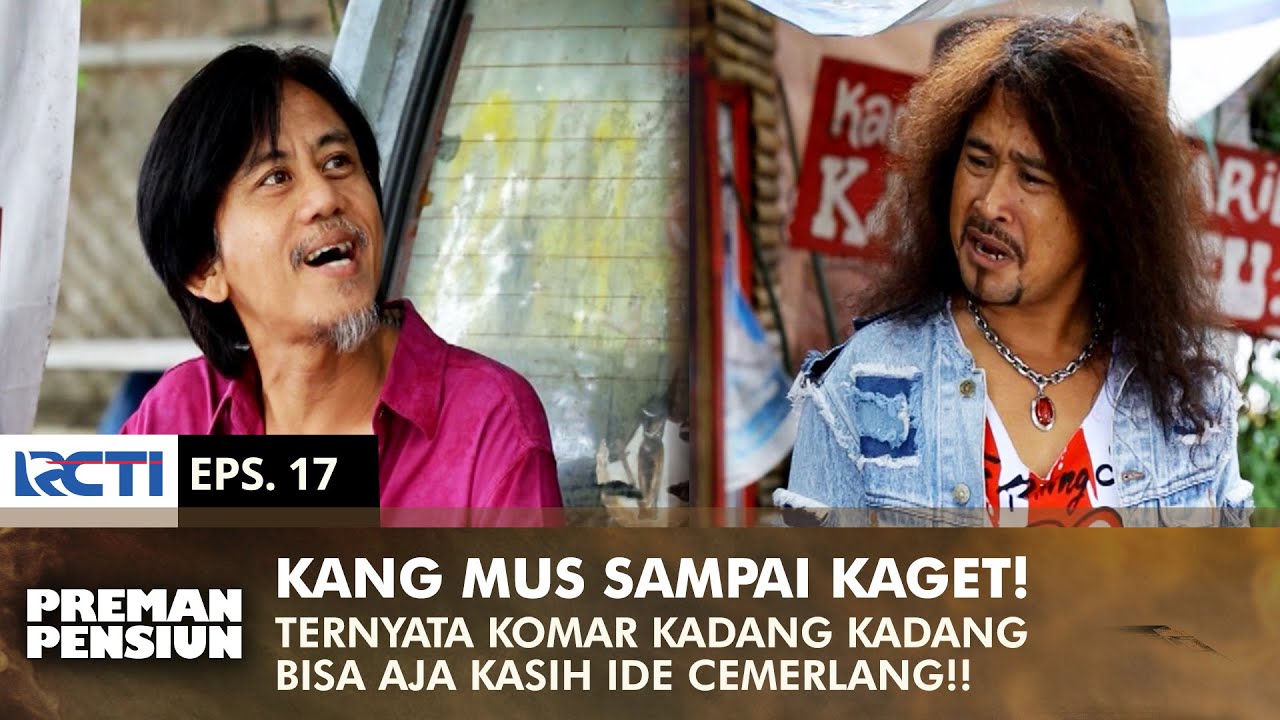

Komar could just give a brilliant idea for Kang Mus | PREMAN PENSIUN 1 | EPS 17 (1/2)

Meet the next generation of young politicians

THIS LAND (2020 Documentary) | The Tenth Man

Juara 1 Film Pendek Isee Undiknas 2020 - Budaya Nyatuang Tresna Short Movie Bahasa Bali 4K

FILM SEBUAH PILIHAN

5.0 / 5 (0 votes)