All About Machine Learning & Deep Learning in 2024 🔥

Summary

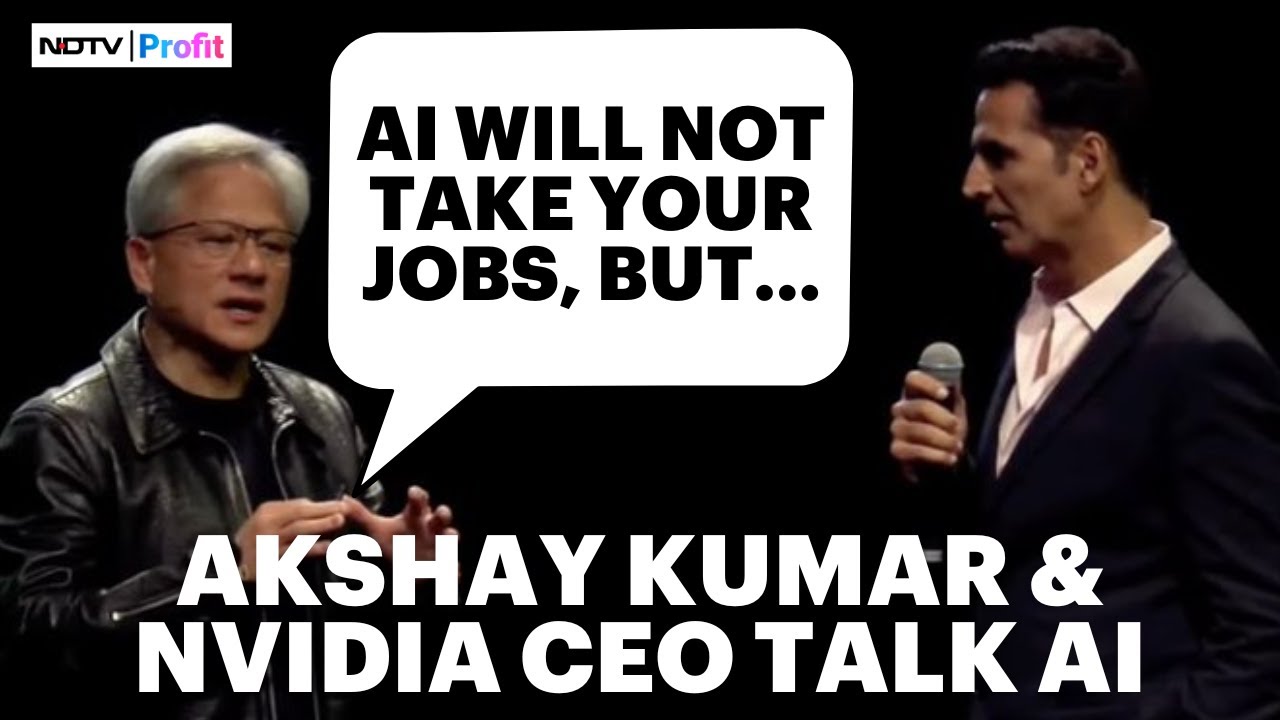

TLDRIn this video, the speaker emphasizes the growing importance of machine learning and AI in 2024, arguing that it’s not AI that will take jobs, but those who learn to leverage AI tools. He explains machine learning's basics, including its types—supervised, unsupervised, and reinforcement learning—and outlines the process of training algorithms with real-world data. The speaker highlights the need for practical implementation skills and recommends resources like Amazon SageMaker and Skillbuilder for learning generative AI. Ultimately, he encourages viewers to embrace AI technologies to stay competitive in their careers.

Takeaways

- 😀 Digital technology has significantly transformed communication methods, enabling faster and more efficient interactions.

- 😀 Social media platforms have reshaped cultural norms and societal behaviors, influencing everything from personal relationships to marketing strategies.

- 😀 The rise of instant messaging has changed how we express emotions, often leading to misunderstandings due to the lack of non-verbal cues.

- 😀 Digital communication tools have democratized information sharing, allowing diverse voices to be heard on global platforms.

- 😀 The prevalence of digital technology has raised concerns about privacy, data security, and the implications of surveillance.

- 😀 Technology fosters a culture of immediacy, where responses are expected quickly, impacting our attention spans and patience.

- 😀 Online communities provide support networks and foster connections among individuals with shared interests across geographical boundaries.

- 😀 The digital divide remains a challenge, as unequal access to technology perpetuates social and economic inequalities.

- 😀 As technology evolves, so do the ethical considerations surrounding its use, necessitating ongoing discussions about responsible practices.

- 😀 Digital literacy has become essential for navigating contemporary society, underscoring the importance of education in technology usage.

Q & A

What is the main focus of the video regarding tax compliance?

-The video emphasizes the importance of understanding individual tax obligations and highlights key strategies for ensuring compliance with tax laws.

What are some common misconceptions about tax deductions?

-A common misconception is that all expenses related to business operations can be deducted. However, only those that are ordinary and necessary for the business qualify for deductions.

How does the video suggest individuals can effectively manage their tax obligations?

-The video suggests keeping accurate records, staying informed about tax law changes, and consulting with a tax professional to ensure all deductions and credits are properly utilized.

What role do tax credits play in reducing tax liability?

-Tax credits directly reduce the amount of tax owed, making them more beneficial than deductions, which only reduce the taxable income.

Why is it important to stay updated on changes in tax legislation?

-Staying updated is crucial because tax laws frequently change, and being aware of these changes can help individuals take advantage of new deductions, credits, and compliance requirements.

What strategies does the video recommend for effective tax planning?

-The video recommends proactive tax planning strategies such as assessing financial situations regularly, maximizing contributions to retirement accounts, and considering the timing of income and expenses.

How can individuals prepare for tax season according to the video?

-Individuals can prepare by organizing their financial documents, reviewing past tax returns, and consulting with a tax advisor to strategize for the upcoming year.

What is the significance of understanding tax brackets?

-Understanding tax brackets is significant because it helps individuals know how their income is taxed and allows them to make informed decisions about income and deductions.

What impact does filing status have on tax calculations?

-Filing status affects tax rates and the eligibility for certain credits and deductions, thus significantly influencing the overall tax liability.

What resources does the video suggest for additional tax guidance?

-The video suggests utilizing IRS resources, tax preparation software, and professional tax advisors for comprehensive guidance on tax matters.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

Google Wrote 25% of It's Code with AI

Bad News for PMPs—The Future Looks Uncertain, Here’s How to Stay Employed

What Nvidia CEO Jensen Huang Said To Akshay Kumar On Losing Jobs To AI

Is Coding Still Worth Learning in 2024?

Debunking 10 Common Misconceptions about AI

The End of the Online Business Era (2026)

5.0 / 5 (0 votes)